SHORT-TERM: COULD SEE GREEN MONDAY BUT MAY SEE DIP FIRST

First of all, take a little time to poll here. I plan to do this on regular basis so that we’ll have our own sentiment poll.

If we’re watching a football or soccer game, now bears got the ball and attacking. Let’s see if they can score the next week to end the current trading range, so kind of key week the next week:

- Very likely a green Monday, but may first dip below the Friday’s low.

- 13 out of 14 (93%) chances, the intermediate-term target is far below the Aug 9 lows. However, in the short-term, I cannot exclude the possibility that we’ll see a rebound first that could jump as high as 73 SPX points. I’ll discuss this in the Intermediate-term Session.

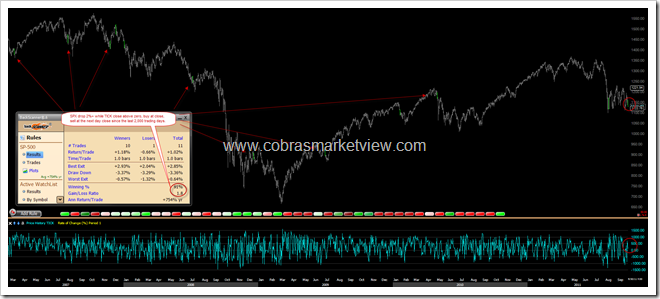

The chart below is how I read the market:

After apparently 2 leg up, the last attempt to a new high failed, forming a pair of lower high and lower low. This basically confirmed that the rebound was failed, as you Earth people usually, after 2 failures on one direction would then try the opposite direction. Now we need see if bears are able to break the green line below to form another pair of lower high and lower low. Although in 09/23 Market Outlook and 09/26 Market Outlook, I’ve listed enough evidences arguing the ultimate breakdown below 09/22 and 08/09 lows, but I cannot prove that bears would fulfill such a breakdown on this attack. All I can say are, now bears are attacking, therefore get better chances than bulls.

Why is very likely a green Monday?

- On Friday, SPX fell more than 2%+ but TICK closed above 0, statistically, 10 out of 11 (91%) chances a green day the next day.

- I’ve mentioned the chart below in the Friday’s Trading Signals, 2 Major Distribution Days within 5 days means 73% chances a green Monday and likely more rebound in the short-term. This chart, by the way, is one of the reasons why I said above that I cannot exclude the possibility of a huge short-term rebound first.

Why will there be a dip below the Friday’s low the next Monday?

- TRIN closed too high on Friday, almost guarantees a lower low the next day.

- A Major Distribution Day means 71% chances a lower low the next day.

- Also, will be mentioning in the Intermediate-term Session, there’re 79% chances, the Friday’s low will be broken the next week.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

Maintain the SPX 1,000 target, see 08/19 Market Outlook for details. Today, I’d like to add yet another solid evidence.

Presented below is the bears safe zone I mentioned in the 09/29 Market Outlook – NYSI Weekly STO sell signal. From the chart, we can draw 4 very useful conclusions:

- Strictly speaking, such a sell signal, HAD a 14 out of 14 or 100% successful rate and the most importantly the profits WERE mostly huge, which in another word is, in most cases, the SPX dropped a lot after such a sell signal.

- There’re 79% chances, this week’s low will be broken the next week.

- There’re 43% chances a green week the next week.

- If short at the Friday’s close, bears would have 2 out of 14 (14%) chances to be underwater for more than 2 weeks, with max draw down up to 73.35 SPX points. In another word is, 86% chances, at the latest the next next week would close below the Friday’s close.

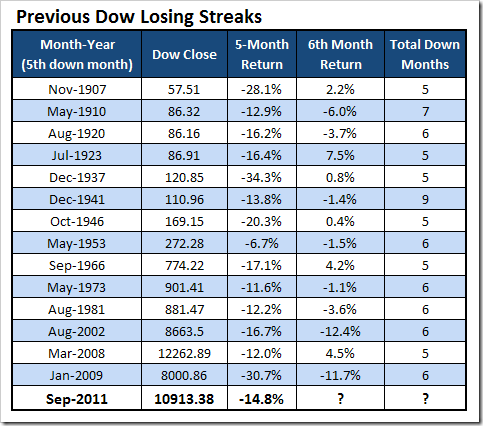

By the way, Dow 5 consecutive red months do not guarantee a green next month, if fact, it has only 6 out of 14 chances, about 43%, see statistics below which is from Schaeffer.

SEASONALITY: BEARISH MONDAY, BULLISH OCTOBER AND 4TH QUARTER

According Stock Trader’s Almanac, first trading day in October, Dow down 4 of last 5.

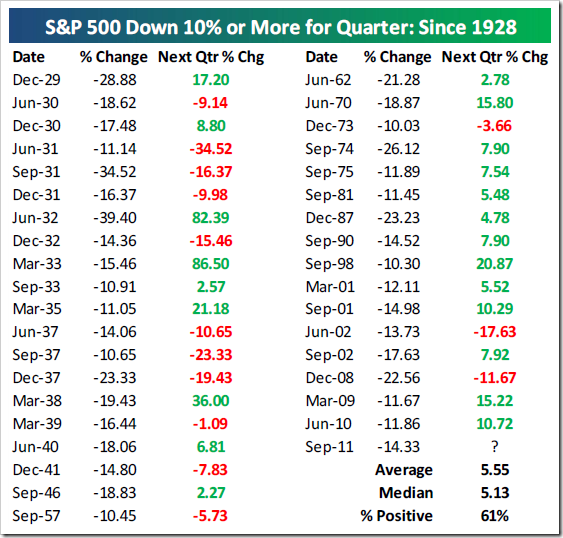

The below statistics charts are from Bespoke. Personally, I don’t see much bullish edges for the 4th quarter especially because the index has been down for the year heading into the 4th quarter.

The below October seasonality chart is from Bespoke.

The below October day to day seasonality chart is from Sentimentrader.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

| ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

|