| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: IN A RANGE, DIRECTION NOT CLEAR

Nothing to say today, the market stuck in a range, so let’s wait for the breakout. I have no idea which direction it’ll break eventually, purely from the chart, however, bears have a little bit edges. If SPX 1173 gets tested again tomorrow, better not hope it’d hold because the 3rd time is the charm.

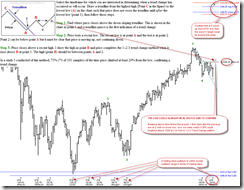

Also, see chart below, although we can count 2 legs down, but the 2nd leg isn’t perfect, especially because it has no lower low so there’s no NYMO positive divergence yet. I don’t mean to imply there’d be a lower low, just info only as purely form “perfect image perspective” the 2nd leg down may not appear completed.

INTERMEDIATE-TERM: 2 MAJOR DISTRIBUTION DAYS WITIN 5 DAYS MEANS MORE PULLBACKS AHEAD

The intermediate-term is in danger of entering a downtrend. See 11/23 Market Recap for more details.

SEASONALITY: MONDAY AND TUESDAY BEARISH, WEDNESDAY (12/01) BULLISH, WHOLE WEEK BEARISH

See 11/26 Market Recap for more details. For November seasonality chart please refer to 11/11 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 11/16 S | |

| NDX Weekly | UP | NASI STO(5,3,3) sell signal. |

| IWM | ||

| IWM Weekly | UP | IWM:SPX too high. |

| CHINA | ||

| CHINA Weekly | UP | |

| EEM | *Hollow red bar on trend line, so rebound? | |

| EEM Weekly | UP | |

| XIU.TO | 11/16 S | |

| XIU.TO Weekly | UP | |

| TLT | *Black bar, pullback? | |

| TLT Weekly | DOWN | |

| FXE | ||

| FXE Weekly | DOWN | |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 11/16 S | |

| GDX Weekly | UP | |

| USO | ||

| WTIC Weekly | UP | |

| XLE | 06/15 L | |

| XLE Weekly | UP | |

| XLF | 10/15 L | |

| XLF Weekly | UP | |

| IYR | Could be a Bear Flag in the forming. | |

| IYR Weekly | UP | Home builders are lagging. |

| XLB | 11/16 S | |

| XLB Weekly | UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Position reported in short-term session of the table above is for short-term model only, I may or may not hold other positions which will not be disclosed.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on weekly chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on weekly chart.