Summary:

Firework may continue with 63% chances the SPX closes in green next Monday.

A surging bond price told a different story however, just I'm not sure if bond and stock should trend together now.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | Wait breakdown bellow SPX 878 to confirm sell signals. |

| Short-term | Up | Neutral |

*Today’s report has no conclusion, stop here you’re simply looking for the word “up” or “down”.

As far as I can see that the last 5 min price surge last Friday made the bulls very excited. Well, not too soon, let’s take a look at the fact first.

http://quantifiableedges.blogspot.com/2008/10/late-day-market-surges.html, statistically it’s called an over reaction, so it doesn’t guarantee an up Monday. Though, we’ve seen lots of similar cases where the price surges right before the market closes, the next day tends to open very high as big money seems to always know something before we retailers. So I could understand the bull’s excitement and am willing to give a support to bulls, hmm, morally.

7.1.0 Use n vs n Rule to Identify a Trend Change, looks like that bears are not that weak.

8.0.3 Use n vs n Rule to Identify a Trend Change 2008, be reminded again how the market usually tops with several up and down.

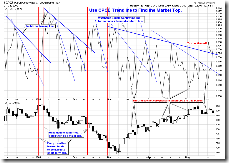

So the conclusion is that before the trading range is actually broken, still there’s a possibility the the market is in a topping process. Also 0.0.3 SPX Intermediate-term Trading Signals, a Descending Triangle could be in the forming therefore a breakout on the downside has higher chance. And also, according to pattern expert Bulkowski: price sometimes breaks out in one direction and then reverses to bust out in a new direction, so even the range is broken, either bulls or bears, don’t yell “told you so” too soon. LOL

Very short-term, not sure an up or down Monday. Yes, CPC < 0.8, so according to 7.0.4 Extreme CPC Readings Watch, there’re 63% chances that the SPX may close in green. And also according to 7.3.2 Firework Trading Setup, the firework shall continue. But, here’s a big but…

7.0.6 SPX and TLT Divergence Watch, we all know that the stock and the bond are trending in opposite direction. OK, let’s see what happened on Friday. Both SPX and TLT were up big. From the chart, we can see whenever this happened the next day was not very pleasant. Well, not too soon to get excited, bears, here comes another big but…

7.1.4 Gold vs Oil, the stock and the yield trending together (since the yield is the opposite of the bond so the stock and the bond are trending in opposite direction) only happens on the age of low inflation while in 90s, when inflation was high, the stock and the yield were trending in opposite direction. The question now is: are the stock and the yield still trending together? In 05/27/2009 Market Recap: The 3rd Bearish Reversal Day, I’d explained that the US government needs to issue huge debt so it’s inevitable that the yield would go higher, but if the yield is tool high, it’d be no good for the economic recovery, therefore logically, I believe from now on, the stock and the yield are trending in opposite direction. And this means that the stock and the bond could rise and fall together. So, accordingly, I cannot rule out the possibility that the rise together of TLT and SPX last Friday was actually healthy. By the way, I’ve been asked several times about the gold, from this chart, if you believe that we’re entering an inflation age then the gold is still very very cheap.

Well, still don’t believe the yield will rise, let me explain it in another way, why it’s inevitable that the yield will be rising. The US government needs to issue around 2T debt while the Fed plans to buy back only 300B, so the rest 1.7T has to rely on us patriots as well as foreign investors, who apparently love the US so much, that no matter how high the stock market is soaring, no matter how low the yield is going and no matter how worthless the US$ will be, simply keep buying and buying and buying the US debt, because we all love the US, yeah!

So the conclusion is not sure about short-term and intermediate-term, be patient, let the market unfolds itself.

The following charts are for your reference only.

1.0.2 S&P 500 SPDRs (SPY 60 min), cycle worked so far so good, and the Friday happened to be the end of 7 trading days cycle.

7.5.0 S&P 500 Large Cap Index (Monthly), 7.5.1 Nasdaq Composite (Monthly), up 3 months in a row, the longest rebound in year 2000 bear market was up 3 months in a row too.