The “Double Confirming Trendline” of 2.8.0 CBOE Options Equity Put/Call Ratio was broken on Friday, this means at least a short-term top has been reached. Like the other indicators, yes, we do need a follow-through to confirm, so today’s report will be about what more we need to see in order to confirm this indeed is a top.

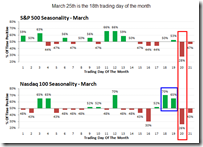

7.1.0 NYSE Composite Index Breadth Watch, the report here: 03/25/2009 Market Recap: 5 more days to go? made an assumption that this rally will go for 18 days without a meaningful pullback. Now 3 days left, I believe we’ll see the true nature of this rally within these 3 days.

- If SPX reaches a high which is higher than 875 then this means for the past 18 up days the SPX has completely recovered the previous 18 down days, therefore, 18 vs 18, bulls win, the intermediate-term rally is as real as it gets.

- If SPX low on Monday is lower than 791, then 2 up days vs 2 down days, bears win, confirming the top argued by 2.8.0 CBOE Options Equity Put/Call Ratio.

- If SPX low on Monday is higher than 791, then bulls win, therefore according to 7.2.1 Buyable Pullback Rule, theoretically the Monday’s dip should be treated as a buyable dip.

2.4.2 NYSE - Issues Advancing, NYADV formed a lower low on Friday which means, before the market reaching a higher high, there’ll be a lower close which should be lower than SPX 816. In other words, for the rest of 3 days of pushing up to SPX 875, there’ll be a down day. So, this down day better be the coming Monday, if Monday, say, closes at 815 (which is the minimum value that is lower than SPX Friday’s close at 816), then for Tuesday and Wednesday, the market has 2 days to push up to SPX 875. 875 – 815 = 60, 2 days for SPX to be up 60 points are still possible. But if the coming Monday is an up day, especially if the high couldn’t be higher than SPX 833, then SPX should drop to minimum 815 (unless, well, the past rule of 2.4.2 NYSE - Issues Advancing doesn’t work this time.), this way, on Wednesday, the SPX must rise more than 60 points to pass 875 which normally is very difficult.

1.1.4 Nasdaq 100 Index Intermediate-term Trading Signals, still overbought intermediate-term, so there’s still a need for a short-term pullback.

1.0.3 S&P 500 SPDRs (SPY 30 min), pay attention to the fast MACD at bottom (Black Curve), this is the 4th sell signal issued, well, maybe a whipsaw again, I’m not sure, the question here is, if there’s the 5th sell signal, how likely it will be a whipsaw again?

To summarize the above, SPX 791 is the key. If SPX drops bellow 791 on Monday, game is over for bulls. If SPX rises on Monday but the high is lower than 833, then it’s likely game over again for bulls (because SPX has to drop on Tuesday, see above analysis). If SPX drops on Monday but the low is higher than 791, then it’s likely game over for bears but SPX must be up more than 60 points within 2 days. So looks to me now, bears have a little up hand, after all, up 60 points for SPX within 2 days is a little bit difficult though not impossible.

1.4.0 S&P/TSX Composite Index (Daily), Canada overbought.

3.4.1 United States Oil Fund, LP (USO Daily), still looks like a Bearish Rising Wedge, if oil drops so might be the Canadian market.