| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

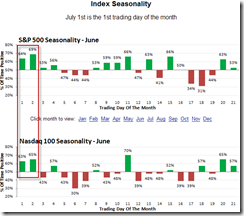

SEASONALITY: BEARISH MONDAY TO WEDNESDAY, BULLISH THURSDAY AND FRIDAY

Form the July seasonality chart (courtesy of sentimentrader) below, we can see tomorrow and the day after tomorrow are very bullish. In the 06/25 Market Recap, I’ve also listed some statistics arguing for bullish tomorrow and the day after tomorrow, take time to review them because the bull’s only hope is the seasonality now. The bottom line, as mentioned in 06/29 Market Recap, QQQQ down 7 days in a row means the downward pressure is high so most likely the very first rebound attempt would fail and after that at least there shall be one more leg down.

INTERMEDIATE-TERM: HEAD AND SHOULDERS TOP TO BE CONFIRMED

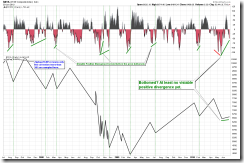

4.1.0 S&P 500 Large Cap Index (Weekly), the main story today is the Head and Shoulders Top neckline breakdown, considering the statistics mentioned in 06/25 Market Recap about weekly bearish engulfing, this Head and Shoulders Top could be as real as it gets, so be careful bulls. Personally, I prefer to wait for a few days to make sure this is indeed a Head and Shoulders Top breakdown.

I purposely post the chart below in advance so that bulls could be prepared, even eventually it proves that I’m totally wrong, it’s no harm to be prepared for the worst case I think. If, I mean IF, indeed the Head and Shoulders Top is confirmed in the following days then the current correction should be at higher level than that of happened in June 2009 and Jan 2010. If the 03/06/2009 to 04/26/2010 was a clear 5 wave up then at least what we are having now is an ABC correction, so the min correction time could be Fib 38.2% from 03/06/2009 to 04/26/2010 which is on 10/02/2010. This looks still far far away and that’s why I want bulls to be prepared in advance. By the way, there’re 2 multiple cycle date confluences area on the chart below. One is 07/31 to 08/02, the other one is 08/22 to 08/24. These 2 time windows could be very important although right now it’s hard to know whether they mean a top or bottom.

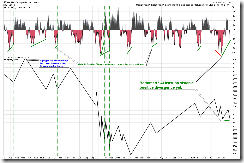

SHORT-TERM: BE CAREFUL OF NASDAQ INTRADAY CUMULATIVE TICK

I said in today’s After Bell Quick Summary that I’d WOW tonight. Here’s the chart. I don’t understand what’s going on here but the cold fact is the previous 8 times (06/25 Market Recap, 06/02 Market Recap, 05/26 Market Recap, 05/18 Market Recap, 05/12 Market Recap, 05/03 Market Recap, 04/29 Market Recap, 04/20 Market Recap and 04/14 Market Recap) when I WOW-ed, the market was all sold off hard no later than the day after tomorrow, so be careful bulls.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

| TREND | *DTFMS | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | UP | *SELL | 0.1.3 Nasdaq 100 Index Intermediate-term Trading Signals: ChiOsc a little too low. |

| IWM | DOWN | *SELL | *Ascending Broadening Wedge breakdown, target $54.97. |

| CHINA | DOWN | ||

| EMERGING | UP | SELL | |

| EUROPEAN | UP | ||

| CANADA | DOWN | SELL | |

| BOND | UP | BUY | Breakout but ChiOsc is way too high now. |

| EURO | DOWN | ||

| GOLD | UP | 4.3.0 Gold Trust Shares (GLD Weekly): Head and Shoulders Bottom, target $129.99. | |

| GDX | UP | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX:$SPX is too high. | |

| OIL | UP | ||

| ENERGY | DOWN | SELL | *ChiOsc a little too low. |

| FINANCIALS | DOWN | ||

| REITS | UP | *SELL | 4.4.3 Real Estate iShares (IYR Weekly): Pay attention to XHB weakness! |

| MATERIALS | *DOWN | SELL |