Summary:

Pay attention to a few past patterns, if market behaviors differently this time then the correction may have started.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Up | ||

| Intermediate | Up | Neutral | Further confirmation needed for the intermediate-term buy signals. |

| Short-term | Down* | Neutral | |

| My Emotion | Wait | Still think this is a bear market rally. |

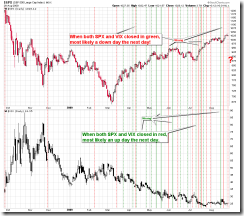

I see different views about the market direction, some are expecting one last new high while the others say that a bigger correction has started. My suggestion is to look back at a few past patterns to see if they behavior differently this time. And if they do act differently then chances are that a bigger correction has already started.

1. Noticed recently that the market was always down 2 down days in a row then rebounded to a new high. This means the market should rebound tomorrow if the past pattern still works, so if there’s no rebound tomorrow then most likely something different is happening. We should then be careful.

2. The intraday pattern today reminds me of the Aug 17, it was also a Monday, opened with big gap down then consolidated the whole day without a further breakdown and then up 4 days in a row to a new high. Also, statistically, if SPX dropped on Friday then opened with a big down gap on next Monday then buying on Monday’s close and held until Wednesday had led to above 90% winning trades. So accordingly if we don’t see rebound or if the SPX Wednesday’s close is less than today’s close then something different is happening. We should then be careful too.

3. Noticed that any bigger pullbacks recently were consisted of 2 gap downs. Today we had the first gap down which means there maybe a 2nd gap down ahead. If so, whether this 2nd gap down could hold or not would help us to identify if a much deeper correction is under way.

Personally, for 2 reasons mentioned on the last Friday’s repot, I maintain the view that at least a short-term top is very close. I will apply the above mentioned 3 patterns to confirm whether my view is correct or not.