Nothing new today, except repeat: overbought, very overbought, very very overbought. This is a sad aspect of TA (or more precisely my poor TA skills), history does not simply repeat exactly itself. I still see a short-term pullback. And very short-term, there should be a pullback at least tomorrow morning. CPC is still less than 0.8 today, so according to 7.0.4 Extreme CPC Readings Watch, 69% chances tomorrow may close in green, just this time I'm not very sure, will explain later. 7.0.1 Extreme NYADV and NYMO Readings Watch, day 3 NYADV remains overbought, according to the past most extreme case, NYADV could remain overbought again tomorrow.

2.8.1 CBOE Options Total Put/Call Ratio, this is the today's main story, 0.65, new low. According to the red dashed lines, the past two times when CPC was bellow 0.7, weren't very pleasant the next day, so that's why I said, I'm not sure about tomorrow. I don't know if the recent rally is a start of an intermediate-term rally, just with such a low readings of the Normalized CPC, I really have difficulties in understanding how far the market can go up. Today's Fed Announcement, by the way, finally made me understand the reason for the March 9 speculation play in chart 7.3.2 Firework Trading Setup, the big money knew today's announcement and therefore bought lots of CALLs, and this is why the CPC keeps going low. So, if my guess is right, if no pullback or just a small pullback tomorrow, the chances are, that this OE Friday, we may see yet another huge firework, so bears be prepared.

2.8.0 CBOE Options Equity Put/Call Ratio, just a quick look, another top signal triggered today.

1.0.2 S&P 500 SPDRs (SPY 60 min), ChiOsc is way too high, this is why I think that the market may pullback tomorrow morning.

For other charts, noting particular, just look how overbought they are.

0.0.2 SPY Short-term Trading Signals, NYADV and NYMO are very overbought.

0.0.3 SPX Intermediate-term Trading Signals, 804 is where Wave reader distinguish between an intermediate-term rally and a correction rally, pay attention there.

Number of SPX stocks closed above MA10,courtesy of www.sentimentrader.com.

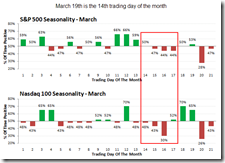

The following chart is just for fun, courtesy of www.sentimentrader.com. The following four days starting from tomorrow are statistically a little bearish biased.

Yong, thank you again for your generosity in sharing your excellent analysis with us. You've been the most accurate this week of the many whom I follow. Your understanding of the CPC ratio is critical in these times.

ReplyDeleteThe question I have is regarding the $CPCE graph that you use to confirm the top and indicate that the market will start to search for its short term bottom. Does your trendline bisect or are we still waiting the CPCE to recover and come back up through it before we can expect a reversal? In other words, can this overbought market condition possibly continue for several days?

The trend line breakout is for the final reveral confirm. This is one of my favourite indicators, never disappoints me.

ReplyDeleteThe Normalized CPC at bottom can stay at extremely low lever for several days therefore the "top" signal today is just a warning.

This blog sure perked up when the market reversed to the upside.

ReplyDeleteMarket action is relentlessly bullish. It makes sense for the market to have continued rising through this period, because bloggers (who drive sentiment among retail traders) have been quite skeptical of the rally. At some point, the bloggers will revert to bullish, and that will yield a short-term top.

Keep in your mind the Heisenberg Principle. High-visibility bloggers -- including you, Yong -- are not only observing the market, you are *influencing* the market.

One is the dog.... One is the Tail...

ReplyDeleteWhich one is the key...

is sentiment driving traders, or traders driving sentiment.

Are High profile Bloggers Driving the market, or are they just reflections of it.

On the H&S. We may be looking for a better defined right shoulder next week.

ReplyDeletegive us a chance to bleed off some of the indicators.

Watch for the SPX 805 today.

ReplyDeleteHeisenberg's Principle:

ReplyDeleteBarron's reported in the March 9 issue that a big money manager (Felix Zulauf) had closed his shorts and was waiting for a bounce. Apparently other big money managers had taken a similar course of action in February.

The readers of Barron's control trillions, so this might have been the jumping-off point for the market. And that the media and retail investors remained negative or inactive was supportive of a rally.

But you cannot blame Yong: I rate him highly, because he is focused on his charts and he is definitely not biased.

But TA can be misleading. Tomorrow’s triple witch has shown all kind of implications these last days. Some indicators have become useless for other reasons, e.g. call/put ratios: with very low stock valuations certain hedging tactics usually applied by the big players are not possible and therefore the indicator might be misleading. More about that in an article by Bernie Schaeffer dated March 17th on his website.

Financials are running again today. Even deadbeats like AIG FRE FNM are pumping hard. The financials will bust SPX 805. I'm seeing SPX 840 and if that doesn't hold then SPX 875.

ReplyDeleteHigh for SPX at 803.24 so far...

ReplyDeleteHey Me XMan;

ReplyDeleteIf SPX 840 then financials(djusfn) will close higher than today? Just wondering for FAZ buying.

Heck SPX 840 would be a gift to short the craps out of financials. FAZ would be in teens in a heartbeat.

ReplyDeleteIt does look like SPX will test 750 before jaming up to test 800 again.

ReplyDeleteNot sure, OE tomorrow, anything could happen. Very good support around 780.

ReplyDeleteYes around SPX 775-780 got good support but it 775 breaks then 750 which is more plausible. Still I think we'll see double top at 800 and then making new lows soon.

ReplyDeleteYou are giving good info on markets.

ReplyDeleteBoise real estate