Summary:

Bulls have 3 days to push above SPX 930 to prove themselves.

Expect more pullback at least tomorrow morning.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | All but one intermediate-term sell signals are confirmed. |

| Short-term | Up | Neutral |

A wide range bar followed by a small range bar on decreased volume, this is a typical consolidation pattern, so both bulls and bears have 50% chances tomorrow. (Please refer to 7.2.0 Small Body Bar Trading Rule for discussion about a day like today) Short-term, I expect more pullbacks at least tomorrow morning. Intermediate-term, according to 7.1.0 Use n vs n Rule to Identify a Trend Change, bulls have 3 days left to prove themselves.

Reasons for more pullbacks tomorrow:

1.0.2 S&P 500 SPDRs (SPY 60 min), still overbought and still looks like a breakdown then back test the broken trend line.

1.0.4 S&P 500 SPDRs (SPY 15 min), negative divergence has already caused a pullback before the close. Because of the overbought on chart 1.0.2 S&P 500 SPDRs (SPY 60 min) mentioned above, so probably there’ll be more pullbacks.

2.0.0 Volatility Index (Daily), MA ENV oversold, it happened 3 times recently, all led to a red day the next day. However, from chart 7.0.7 SPX and VIX Divergence Watch, when both SPX and VIX closed in red on the same day, 5 out of 6 times recently the next day closed in green, so accordingly, I’m not sure if the market could eventually close in red tomorrow.

Intraday Cumulative TICK from www.sentimentrader.com, overbought.

STEM.MR mode (which is a short-term trading mode) from www.sentimentrader.com, overbought.

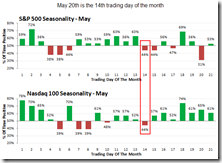

Seasonality from www.sentimentrader.com, statistically tomorrow will be the 2nd most bearish day in May.

The following are for your info only:

3.4.1 United States Oil Fund, LP (USO Daily), I believe USO will breakout on the upside eventually. This is good for the overall market, especially Canadian market, for a short period of time at least. But, I wonder (well, don’t think too much, this has nothing to do with today’s market analysis), if you have ever noticed that now you have to pay more to fill your tank?

Institutional Buying and Selling Trending, posted this morning, it seemed that institution didn’t participate the yesterday’s rally. Tomorrow morning before opening, again I’ll post the most updated chart. If the trend goes on, i.e. the market simply up and up without institution’s participation, bulls better be careful.

Large Nasdaq Price Moves On Weak Volume, enough said the consequences of a big up day like yesterday without much of institutional participation.

Another TICK Milestone, TICK was extremely bullish in the recent 2 days (well, I didn’t notice that), 3 times this happened, I checked myself, it’s not exactly as what the post said, “a short-term weakness”, it’s actually a very big correction.

Anyway, if the above info is true, I believe we’re very close to a turning point now.

0 comments:

Post a Comment