Summary:

Bulls have 4 days to push above SPX 930 to prove themselves.

Expect a pullback tomorrow.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | All but one intermediate-term sell signals are confirmed. |

| Short-term | Up* | Neutral |

The strength of the today’s really is really a surprise to me. If this kind of strength goes on, then very soon, all the intermediate-term sell signals generated last Friday would turn out to be a whipsaw. So now 7.1.0 Use n vs n Rule to Identify a Trend Change should be used to determine who’s stronger bull or bear. Since it took bears 5 days to push SPX from 930 down to 878, then we should give bulls equally 5 days (including today) to see if they can push SPX higher than 930.

Tomorrow, I expect a pullback and a red close.

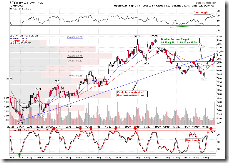

1.0.3 S&P 500 SPDRs (SPY 30 min), very short-term very overbought, so expect a pullback at least tomorrow morning.

2.8.0 CBOE Options Equity Put/Call Ratio, way too bullish, from the chart we can see whenever CPCE readings were this bullish, the 2nd day was not very pleasant with no exceptions so far. So accordingly, I expect a red close tomorrow.

The follow charts are your info only.

1.3.7 Russell 3000 Dominant Price-Volume Relationships, 2 dominant relationships today: 1361 stocks price up volume down which is bearish; 1274 stocks price up volume up which is bullish. So I don’t think it’s actually bearish for having today’s up on decreased volume.

1.0.2 S&P 500 SPDRs (SPY 60 min), well, it seems OK SPY could have as many gaps as it wants as long as it’s an up gap. So far bulls have 7 unfilled gaps while bears have only 1 now(within short period).

The hyperfocus on 875 as a joint target for both bear and bull to catch a bounce was highjacked in the night by futures traders then sqeezed up by short covering and amatuers;

ReplyDeleteperhaps tuesday bears will retaliate with a gap down full-body red candle

causing all maner of technical damage. Thanks for your work, Cobra.

Dear Cobra,

ReplyDeleteTech was one of the leaders in this latest rally, but it appears it too has also resumed its strength after having faultered prior to the S&P weakness. Is this what you are seeing as well? It would give more support to the idea the powers that be want these markets to move higher at any cost. Strangely, though, it is likely causing Bernanke headaches with the 10yr yield starting to run away.

Are you thinking the same thing?

Thank you,

-A.

Are there any EW followers on this blog?

ReplyDeleteMajor wave A was 167 $SPX points (666 up to 833)

Major wave B was only 53 points (833 down to 780)

Major wave C at 947 would be symmetrical (780 up to 947 = 167 points, just like wave A)

Today's 200ma just happens to be 947

The 200ma (or a breach just above) would be a logical place for Primary wave B up to end and for Primary C down to begin.

This AM doesn't look like market want to pull back.

ReplyDeleteDude, you just got a shout out from Bill Luby

ReplyDeletehttp://vixandmore.blogspot.com/2009/05/two-blogs-to-get-me-caught-up.html

IMO you two are must reads.

ADD, I don't think NDX is leading now. Still looks like a bear flag on the daily chart to me.

ReplyDeleteDave, yeah, I saw Bill's posted and paid a visit to him. Thanks for letting me know.