Summary:

Evening Star plus multiple cycles turn date and plus potential NYMO sell signal tomorrow, so could be more pullbacks ahead.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Up | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | 11/11 S | 2 x ATR(10) | 2 x ATR(10) is 4% for SPY. For 2x ETF use 8% and for 3x ETF use 12%. | |

| Reversal Bar | 11/11 S | 0.8xATR(10) | Stop loss is approximately 2% for SPY. | |

| NYMO Sell | *Short if Open > Close tomorrow. |

| ||

| VIX ENV | ||||

| Patterns ect. |

INTERMEDIATE-TERM: COULD BE MORE PULLBACKS AHEAD

Although the pullback today may mean nothing but based on some other evidences, I see more pullbacks ahead.

6.4.0 SPX and NYMO Divergence Watch, so far worked OK. In addition, if tomorrow, SPY Open > Close, then the NYMO Sell setup will be confirmed, which is a fairly decent setup because it had 65% winning rate and 5.2 Gain/Loss Ratio. Just I won’t follow this setup because I followed the ST Model yesterday as the risk is high to follow a similar setup when the current position has not much profit. However, like the Reversal Bar setup, I’ll update the signals as if I’m following them for your references. Again, these are merely mechanic signals so treat them as fun stuffs.

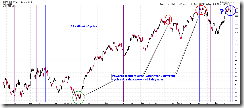

0.0.2 SPY Short-term Trading Signals, Evening Star, bearish reversal 72% of the time.

3.3.0 streetTRACKS Gold Trust Shares (GLD Daily), according to 6.4.5 GLD and UUP Watch, gold leads US$ recently so the Evening Star formed on GLD daily chart today may mean gold to pullback and therefore US$ to rise which is not good for the stock market.

1.0.9 SPX Cycle Watch (60 min), strong reversal if multiple cycles clustered together. Now we have again 2 cycles due together, unless the market opened with a couple hundreds down tomorrow otherwise it looks like the next cycle will be a down cycle. This also coincide with the 10 day cycle due tomorrow on chart 0.0.3 SPX Intermediate-term Trading Signals which I mentioned in the yesterday’s report as high likely a down cycle.

SHORT-TERM: NO UPDATE

INTERESTING CHARTS: NONE