Summary:

SPY is too high above MA200 plus UUP could rebound so expect some days of consolidation then pullback.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Up | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | 11/17 | *Enter Long. | *11/04 Low |

|

| Reversal Bar |

| |||

| NYMO Sell |

| |||

| VIX ENV | ||||

| Patterns ect. |

INTERMEDIATE-TERM: COULD BE MORE CONSOLIDATION THEN PULLBACK

Not much info as today is a typical consolidation day. My guess is could be more consolidation (2% to the upside the most) then pullback.

Two reasons:

SPY 20% above MA200 could mean consolidation then pullback (see red bars). The original idea is from here: Stocks Have Little Room to the Upside.

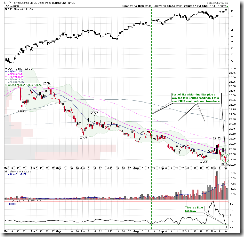

3.1.0 PowerShares DB US Dollar Index Bullish Fund (UUP Daily), Morning Star plus ChiOsc too low (see dashed green lines), so UUP could rebound which may cause the stock market to retreat.

SHORT-TERM: NO UPDATE

INTERESTING CHARTS:

The final $GOLD reading has confirmed that today is an ALL UP DAY. This should mean a big pullback tomorrow.

However, my back test software does not have $WETI and $GOLD which I used in the www.stockcharts.com so the back test results are very different (see red bars). Since I don’t see any edges by using different oil and gold indexes as theoretically the results should be very close, so I’m now not sure if ALL UP DAY indeed means a big pullback. We’ll know tomorrow.