| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: TODAY’S LOW IS NOT THE LOW

The rebound before the close as well as GOOG ER in AH may feel like the pullback was over. However, most likely today’s low is not the low, so either SPX will rebound to higher high before pullback which looks more likely the case now, or it may continue to pullback tomorrow, after all, from the SPY daily chart, Shooting Star plus Hanging Man could mean a reversal.

Why I think today’s low is not the low? Although in the most bullish case, it may take 2 to 3 weeks before visiting today’s low.

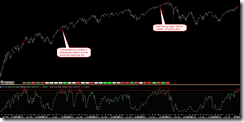

Percent of SPX stocks 1 std dev above MA(50) still is too high, see highlighted in red, although higher high was guaranteed thereafter but also today’s low was guaranteed to be revisited.

Institutional Selling Action from Stocktiming. It looks more and more like the April case as institutions selling keeps increasing despite the market keeps having higher high, so bulls still need to be careful.

INTERMEDIATE-TERM: BEARISH BIASED

Maintain the intermediate-term bearish view. Below are summaries of all the arguments I’ve been blah blah recently:

- As mentioned in 10/08 Market Recap, commercial (smart money) holds record high short positions against Nasdaq 100.

- As mentioned in 10/08 Market Recap, AAII bull ratio (4-week average) is way too bullish.

- As mentioned in 10/08 Market Recap, institution selling keeps increasing.

- As mentioned in 10/08 Market Recap, statistically, a strong off-season could mean a weaker earning season.

SEASONALITY: OCTOBER EXPIRATION MONAY WAS BULLISH, EXPIRATION DAY WAS BEARISH

According to Stock Trader’s Almanac:

- Monday before October expiration, Dow up 24 of 29.

- October expiration day, Dow down 4 straight and 5 of last 6.

For October Seasonality chart please refer to 10/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ | UP | 4.1.1 Nasdaq 100 Index (Weekly): NDX to SPX ratio too high. |

| IWM | UP | |

| CHINA | Confirmed breakout, very bullish. | |

| EMERGING | UP | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. |

| CANADA | UP | TOADV MA(10) too high. |

| BOND | DOWN | |

| EURO | UP | |

| GOLD | UP | |

| GDX | UP | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high. |

| OIL | *LA | |

| ENERGY | UP | *The 2nd hollow red bar, pullback? |

| FINANCIALS | *DOWN | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? *3.4.0 Financials Select Sector SPDR (XLF Daily): Black bar under important resistance, pullback? |

| REITS | UP | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging. |

| MATERIALS | UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no specific buy/sell signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update.

- Blue Text = Link to a chart in my public chart list.

- LA = Lateral Trend.