| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: TWO RELIABLE TOP SIGNALS TRIGGERED, BULLS BETTER TAKE SOME PROFITS

Two top signals were triggered today, considering the first possible pivot date mentioned in 10/15 Market Recap is around 10/21 to 10/22, so there’re chances that today is the top. I know, when I said this, most of you for sure won’t believe it, even myself dare not to believe as well. However, since according to 6.5.2c Week Seasonality Watch, more likely we’ll see a red week the next week, so it might not be a bad idea for bulls to take some profits around here, especially if you followed the SPY ST Model, as the model is designed to stay in a trend as long as possible so it has no profit taking signals which is totally up to you to decide, and I think now probably is the time.

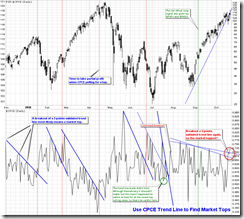

0.0.2 Combined Intermediate-term Trading Signals, 3 point validated trend line breakout, actually twice, so it should be even more trustworthy than just breakout one 3 pointed validated trend line. Those of you who followed me for a long time should know that this signal is very accurate, so be careful here, especially if the trend line could hold tomorrow.

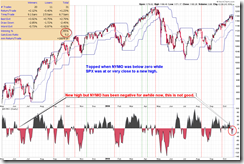

6.4.0 SPX and NYMO Divergence Watch, SPX new high but NYMO is clearly in red. I have a similar setup called NYMO Sell that uses the same principle, see the top left corner in the chart below, the setup has 65% winning rate (since 2002) while the gain loss ratio is 5.2 which is astonishingly high and which means the setup is very effective in catching an exact top. 6.4.0 SPX and NYMO Divergence Watch, on the other hand, because it depends on my “visual contact” to trigger a sell so it has even higher winning rate, see dashed red lines vs dashed green lines below (8/11 = 73%).

INTERMEDIATE-TERM: BEARISH BIASED, PIVOT DATE EITHER AROUND 10/22 OR 10/26 OR 11/04

Maintain the intermediate-term bearish view, the pivot date could be either around 10/22 or 10/26 or 11/04, see 10/15 Market Recap for more details. Below are summaries of all the arguments supporting my intermediate-term bearish view:

- As mentioned in 10/15 Market Recap, commercial (smart money) holds record high short positions against Nasdaq 100.

- As mentioned in 10/15 Market Recap, AAII bull ratio (4-week average) is way too bullish.

- As mentioned in 10/15 Market Recap, institution selling keeps increasing.

- As mentioned in 10/08 Market Recap, statistically, a strong off-season could mean a weaker earning season.

- As mentioned in 10/11 Market Recap, statistically VIX at 1 month low going into October was not a good sign.

- As mentioned in 10/15 Market Recap, US$ may rebound which is not good for the broad market.

- As mentioned in 10/19 Market Recap, IBM dropped after ER may mean SPX red in 5 weeks.

- As mentioned in 10/19 Market Recap, AAPL MACD is now too stretched which could mean a top for QQQQ.

SEASONALITY: NO UPDATE

For October Seasonality chart please refer to 10/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

- The market appears a little stretched as lots of ETFs weekly %B are way too high.

- With possible Euro pullback, watch potential weakness on commodity related ETFs like XLE, XLB and XIU.TO.

| TREND | COMMENT | |

| QQQQ | LA | |

| NDX Weekly | NDX to SPX ratio too high. %B too high. Neither had any edges though. | |

| IWM | DOWN | |

| IWM Weekly | %B too high. | |

| CHINA | Rejected by downtrend line, watch… | |

| CHINA Weekly | Extremely high %B. | |

| EEM | DOWN | |

| EEM Weekly | EEM to SPX ratio too high, %B too high. Neither had any edges though. | |

| XIU.TO | LA | TOADV MA(10) too high. |

| XIU.TO Weekly | Fib 61.8% plus %B too high with negative divergence. | |

| TLT | *DOWN | 1-2-3 trend change? So TLT could be in an intermediate-term downtrend. Be careful. |

| TLT Weekly | ||

| FXE | *LA | *Bearish reversal bar, combining with weekly chart, so pullback? |

| FXE Weekly | Stalled at Fib confluences area, %B too high with negative divergence, too high above MA(40). | |

| GLD | DOWN | |

| GLD Weekly | %B too high. | |

| GDX | DOWN | On support, BPGDM sell signal though. |

| GDX Weekly | GDX to SPX ratio too high, %B too high with negative divergence. | |

| USO | *DOWN | |

| WTIC Weekly | ||

| XLE | LA | *Bearish reversal bar, combining with weekly chart, so pullback? |

| XLE Weekly | %B too high with negative divergence. | |

| XLF | *LA | |

| XLF Weekly | Head and Shoulders Top in the forming? | |

| IYR | UP | |

| IYR Weekly | Home builders are lagging. | |

| XLB | UP | |

| XLB Weekly | %B too high with negative divergence. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Position reported in short-term session of the table above is for short-term model only, I may or may not hold other positions which will not be disclosed.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore offer no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list; UP/DOWN = Short-term trend; L A = Lateral Trend