The Friday's later day surge was the 3rd time we had recently. The previous 2 were all sold off the next day. So is 3rd time the charm or still the same easy money for bears? Well, I tend to believe that the 3rd time will be different. So short-term, the bounce might live a little longer than one day. And as for intermediate-term, if the past experiences still work at this crazy time, I tend to believe that Friday was not a bottom. Reason: the later day surge was too fast, conventional bottom day reversal usually doesn't act this way.

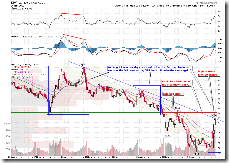

1.0.4 S&P 500 SPDRs (SPY 15 min), chart says everything. Friday's surge was the 3rd time. And I do believe that the 3rd time will be different.

2.1.2 NYSE - Tick, note the blue thick line just hit the thin green line which always generated very good bounces in the past. The bounce usually carried the thick blue line above the zero before running out of the steam. The Friday's surge didn't push the thick blue line above the zero, so this probably means there's still some room left for the bounce.

3.0.0 10Y T-Bill Yield, ROC30 has reached an extremely low level which in the past always caused some big rallies, so this also supports that there might be some up room left for the bounce.

2.0.0 Volatility Index (Daily), possible Bearish Rising Wedge, plus STO hit resistance, VIX might drop further and this is good for the market.

1.0.3 S&P 500 SPDRs (SPY 60 min), how far will the bounce go? Look at tons of resistance ahead, period.

0.0.4 SPX and Breadth Divergence Watch, for above mentioned reasons, I myself have decided to ignore what this chart says, but it's my responsibility to let you know that on Friday, NYAD failed to confirm the surge. This was exactly the same pattern as that of Nov 13th which was sold off the 2nd day. So be careful here.

If we do get a further bounce, then here's a simple rule to verify if the Friday is a bottom.

0.0.2 SPY Short-term Trading Signals, in order to prove that this was a trend reversal instead of a bounce, on Monday, SPY should have a high which is higher than 86.87. Why? As my previous report described, 2 down days vs 2 up days, the latter should fully recover the previous 2 in order to prove that the up strength is stronger. By the way, STO, NYADV and TICK are still in the oversold area, so as well, they support a further bounce.

3.1.0 US Dollar Index (Daily), Bearish Dark Cloud Cover, US$ might pullback.

3.3.0 streetTRACKS Gold Trust Shares (GLD Daily), breakout, although the RSI2 above is overbought. If US$ pullback, gold will have good chances of going further up from here.

5.0.2 S&P Sector Bullish Percent Index, from the Bullish Percent Index point of view, all sectors are back to historical low level now.

Great post today, Cobra. I think you are right on. Thanks!

ReplyDeleteI think its gonna climb a few days possibly light volume this coming week pretty easy for it to climb a bit. I think we will still see a fall at the end of the month, beginning of dec. good post today

ReplyDeletethanks again

Cobra Lao Da, HT is down. Really appreciate for the posts here. Just have an educational question for you on the USD daily Index. If you look back last 7 bars at Nov 13th. Was that a BEARISH ENGULFING candle? If I did short from their, then I should put my stop at the high of this candle. Was my reading righ?

ReplyDeleteThank you in advance.

Hi, Bokchoy,

ReplyDeleteYes, that was a Bearish Engulf, and yes the stop is logically right. But, normally Bearish Engulf needs a follow-through to confirm. The Nov 13th Bearish Engulf didn't have the follow-through.