Finally the market has been up in two consecutive days. What is even more promising is that SPY has fully reclaimed the loss in previous two down days within this two up days. So this is the first time that the market showed some up strength for a long time. Next the market may likely pull back, and how big the pullback is will be a key to predict if this is a oversold bounce or intermediate term trend reversal. Similarly, if the market does pull back for two days, we should check out whether the two down days fully takes off the two up days gain.

There is no clear signal to predict the market will pull back tomorrow. However a few statistics show that the likelihood of pullback tomorrow is quite significant.

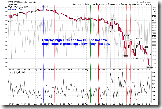

8.0.6 TICK and CPC. This is most significant today, TICK closed above 1000, and CPC is way too bullish at 0.74. However, two data are insufficient to draw a conclusion of pullback. On the chart, there are 8 green lines which represent the next up day, and 12 red lines which show the next down day, so the possibility of getting a down day is about 67%. Concerning the very low level of CPC, it doesn't necessarily means the market would correct on the next day according to the blue dashed lines on the chart.

1.0.5 Major Accumulation/Distribution Days. Today is a major accumulation day, and the chart shows that the market might likely close lower.

1.3.7 Russell 3000 Dominant Price-Volume Relationships, 1969 stocks price up volume down, very bearish. Although a short week may explain in some extent, I still consider 1969 a big number and this is relatively bearish pattern. According to the statistics, the market may pull back tomorrow or as late as the day after tomorrow.

1.0.4 S&P 500 SPDRs (SPY 15 min), 1.1.6 PowerShares QQQ Trust (QQQQ 15 min), MACD and RIS show negative divergence. Although the pattern isn't very significant, it is still a bit bearish to the further rally.

As mentioned early, pullback is okay and it is healthy. The key is how big the pullback is. There are two signs concerned me. Whether my concern will become serious depends on how the market goes in the next few days.

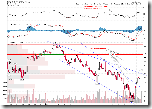

1.0.3 S&P 500 SPDRs (SPY 60 min). The RSI 50-60 region has not broken out yet. Unable to reach 70 of the oversold level is a sign of weakness for the market.

3.2.4 Yen RSI and the Market Top/Bottom. Recently the level of RSI of Yen has marked the market top for several times. Let's see if it becomes true again.

3.1.0 US Dollar Index (Daily). US dollar broke down and confirmed the bearish dark cloud cover, which is a good news at the moment because the pullback favors the rally of commodities, and in turn this is a good news to commodities stocks.

2.0.0 Volatility Index (Daily). VIX also broke down the bearish rising wedge, which is also a good news.

2.3.4 Nasdaq Total Volume/NYSE Total Volume. This is quite encouraging too. A relatively low value often means the market is bottomed out.

1.5.0 Shanghai Stock Exchange Composite Index (Daily). The mainland market market may not be able to pass 50-day moving average.

I continue to enjoy your work. Thank you for your generosity in sharing it.

ReplyDeleteTom

Thanks for sharing your analysis, Cobra. My first time visiting your site, but I like it alot and I'll be back.

ReplyDeleteExcellent work. I enjoyed.

ReplyDeleteThanks You

Cobra, just found your blog over the weekend, awesome work. Thanks so much for sharing.

ReplyDelete