The Friday's later surge made bulls on my Chinese forum very excited, but I guess it might mean nothing, at least a follow-through Monday is needed.

Three points to say:

1. I still insist "no panic no bottom". In my Chinese forum (which should be the most popular Chinese stock forum in North America. I don't mean to brag here, I just mean that it can represent what most people think), the same argument of "VIX may not spike this time" happened before Jan, March and July bottom last year. Now the same argument rose again, exactly the same reasons for "not spiking this time", the only differences are now the argument came from different IDs.

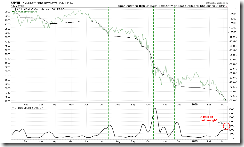

2. Seldom a bottom is formed by a later day surge, the only exception recently was 11/21/2008, so I'll compare the Friday's later surge with that of 11/21/2008 in today's report.

3. The market is extremely oversold, a rally could happen at any time, so if we do get a follow-through Monday, according to my "equal up and down" rule, the high should be higher than SPX Wednesday's high which was 724, in order to confirm that the Friday was indeed a bottom.

7.1.0 NYSE Composite Index Breadth Watch, 11/21/2008 was a very strong day, besides the breadth and the volume differences, most of all, Russell 3000 Dominant Price-Volume Relationships argues a lot: On 11/21, we had 1367 stocks price up on volume up which was the most bullish price-volume relationships, while on Friday, there wasn't any dominant price-volume relationships, the largest number was 796 stocks price up volume down which was the most bearish price-volume relationships.

I have an impression that every time before bottom is formed, there always are some failed intraday reversal attempts until, well, the last one. So let's take a look at how many failed reversal attempts before 11/21/2008. If you have time, read this: 11/21/2008 Market Recap: Is 3rd time the charm?. I didn't correctly call the bottom, the reason was the same "seldom a bottom is formed by a later day surge", but I did, according to "the 3rd time will be different", predict a follow-through and after the follow-through, via "equal up and down" rule, the bottom was confirmed. OK, we may apply the same method nowadays. To me, the Friday's later surge looked like a 2nd reversal attempt, so accordingly, I suspect that if there'll be any follow-through on Monday. And also about "equal up and down" rule, if we do have a follow-through Monday, remember, the high of SPX must be higher than 724. Bellow are 2 charts, the 1st one is around 11/21/2008 where I see at least 3 reversal attempt, while the 2nd one which is now, so far I only see 2 reversal attempts.

1.0.3 S&P 500 SPDRs (SPY 30 min), STO has remained under oversold for too long which was rare, plus positive divergence everywhere, so there's a hope that we might see an up Monday. I'm not sure though as statistically, Monday tends to close in red.

1.3.3 Russell 2000 iShares (IWM 15 min), ChiOsc is way too high, period.

Before the end of this report, I'd like to share you a new chart. I've put this in 2.4.3 Breadth Oversold/Overbought Watch.

Cobra,

ReplyDeleteYou have been doing an excellent job. Could you please elaborate more on your last chart? I didn't quite understand what you are trying to say.

Keep up the good work....

Thanks. The last chart may mean the drop is not enough. Just a possibility, not a sure thing though.

ReplyDeleteCobra,

ReplyDeleteGreat work. I found your blog a few days ago and watch it ever since.

My sense is we bottom in the OEX week, that's the optimal time for market to bottom, and PPT usually pick that time as well. If you check the Nov, Oct, and Sept low, it's all around OEX week.

What do you think?

Is Pan Yong your Chinese name? I am Chinese too, be in US for 16 years.

Keep up the great work!

Simpletrade

don't know why my earlier comment didn't post.

ReplyDeletestill in minor wave 3 of 5, so much more room to go down. I think everyone is anticipating the minor wave 4 retrace...at least I am. It should be here soon, but with the headfakes, timing is difficult. I think we have much more downside...to the black trendline...see link. GLA.

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=10&dy=0&id=p83299842393&a=162347069

On the timing of wave 4 of 3 of 5, according to spiral calendar and tides/gravity ( see http://spiraldates.com/?p=115 ), March 11th is the center of a window for a turn higher next week.

ReplyDeleteThank you guys. I heard lots of prediction around OE week (calculated from different method). Let's see what market brings us. If Monday does bring us a good follow-through, I'll still cheer on it though.

ReplyDeleteYes, Pan, Yong is my Chinese name, it's not "brave" Yong though.

One of my favorite charts of yours in figuring out the bottom is 1.1.7 QQQQ Outperforms SPY Good Sign?

ReplyDeletehttp://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2393449&cmd=show[s141838753]&disp=P

The NASDAQ is still way too high in relation to the market. When the NASDAQ plummets to correct this (along with the market), that will at least be a short-term bottom, I think. Based on Friday's underperformance of NASDAQ, a short-term bottom seems very close.

It may take very long time for 1.1.7 to work, be prepared.

ReplyDeleteinteresting that you have a large chinese group of readers. Chinese tend to be gamblers and I usually fade what they do as they are normally wrong. :)

ReplyDeleteAnonymous, the seriousness of Yong's work is quite contrary to what you imply. Having said that, 20 % of the comments does not mean that 20 % of the readership is Chinese. And where is your evidence that 'Chinese tend to be gamblers'? It is one of those prejudices folks tend to blat out when they try to deflect from their own obsession. Anonymous, are you a gambler?

ReplyDeleteI'm a different "Anonymous."

ReplyDeleteI don't know what the other guy is talking about, but I have heard that the Chinese really like gambling. That said, making a generalization about over a billion people is stupid. There are probably quite a few Volvo-driving, bridge-playing American vegans who smoke unfiltered cigarettes, but if you think that is the norm, then you are smoking unfiltered CRACK.

Also, Yong referenced his Chinese-language blog. This isn't that blog, people, so the percentage of comments on this blog from Chinese readers has nothing to do with Yong's comments.

Finally, this market is in a sustained downward trend. I am long (not much, but any is too much), so the market will continue to fall until I sell. When I do, I will post here to let you know. That way, you will all know when to go long. We'll call it the "Anonymous Indicator." Remember you heard about it here first, because it will one day be widely discussed on CNBC, in the WSJ, etc. as the most reliable indicator EVER.

;)

The bottom of the SNP is 2,800.

ReplyDeleteThat's my prediction. Based on a 4/5s drop from the Nikki high to the final bottom in 2004.

you guys keep mowing the same grass, while index traders keep taking your stock vestments off the table.

Enjoy the coming bank holiday!

Ooops, the bottom of the Dow is 2,800.

ReplyDeleteThat would be 300 on the SNP.

The $NYMO and the $NASI seem to be nearing a bottom but I can't figure out the $CPC. It's more near a top than a bottom. How can there be this much enthusiasm for calls at this level? I would seem to confirm that a bottom isn't near.

ReplyDeleteI'm wondering the same thing now. So far now CPC is only 0.75, guess it's just a speculative play on possible Thursday's Mark-to-Market rule changes.

ReplyDeleteno rule changes on Thursday...just another meeting of the great minds that continue to screw up the financial markets.

ReplyDeleteCobra,

ReplyDeleteCan you please compare Dow Jones Industrial DJIA now daily with DJIA (daily) at year 1938 April?

No, I don't have data for 1938.

ReplyDeleteChanges or no changes don't matter, the market needs a rumor to buy, that's it.

Anonymous 2:44 PM, this link might help you:

ReplyDeletehttp://blog.afraidtotrade.com/amazing-similarities-in-dow-jones-1937-and-today/

Cobra... Can you revisit the GLD correlation? GLD seems to have given up its gains... thoughts?

ReplyDeleteRik

Seems like GLD needs a further pullback.

ReplyDeletemore pullback? it bounced nicely of it's 50dma. plus even the bears seem to be wearing out. seems like the timing would be right for another launch. any thoughts/charts?

ReplyDeleteRik

Yes, it bounced right from support but was on decreased volume, so could be more pullback. I'm not very sure though.

ReplyDelete