Very short-term, the market is overbought, so should pullback at least tomorrow morning. Short-term, since the low CPC has triggered a "firework setup", so the market could rise for several consecutive days (may have small red consolidation days in between though), until one day the market opens with a big down gap. Intermediate-term, well, let's wait until the "big down gap day" before making any conclusions, OK?

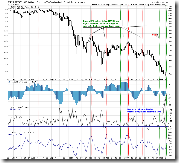

0.0.4 SPX:CPCE, this is a story for the coming several days (hopefully), CPC < 0.8 plus MACD buy signal, a "firework" was triggered today. The profits were very good in the past. Let's pray it works again this time.

1.0.3 S&P 500 SPDRs (SPY 30 min), 1.0.4 S&P 500 SPDRs (SPY 15 min), TICK and STO are very overbought, so a pullback could be at least tomorrow morning. Usually after a big price bar, there'll be one or several small price bars (consolidation on decreased volume), so my guess is tomorrow we may have a small price bar which has 65% chances of closing in green. Why 65% chances? 7.0.4 Extreme CPC Readings Watch, when CPC < 0.8, 15 out of 23 times recently the next day closed in green.

5.3.1 Financials Select Sector SPDR (XLF 30 min), Financials are very overbought, period.

Hey Cobra,

ReplyDeleteGreat blog! What retracement level do you think XLF will get to before it tops out? Do you think the firework starts down again by the end of the week?

Keep up the great work :)

30 min chart Fib 61.8 for XLF, I guess.

ReplyDeleteMy guess is down or flat tomorrow, then up Thursday and Friday. Don't know next week.

Hi Cobra,

ReplyDeleteWhat are your thoughts on today being a huge accumulation day? I've noticed that we've either had an indecisive or a down day following accumulation days.

Thank you for providing awesome TA on a consistent basis.

Yeah, high chances down day after a Major Accumulation Day, but not with CPC < 0.8, so hard to say tomorrow.

ReplyDeleteThank you for your time and effort.Where do you think the SPY will pull back to? Will it pullback to 700-705 to form a left shoulder? we are forming an inverse head and shoulder since the beginning of March with left shoulder and head formed already.

ReplyDeleteCobra,

ReplyDeleteWhat base your argument stands that this rally will be followed by a big down gap day?

I have a difficult time considering that an inverse head and shoulder will come to fruition with the open gap below. As Cobra notes, not when it occurred on .80 CPC

ReplyDeleteA big gap down is concluded from the past pattern. CPC too low means that people are way too bullish, so eventually this kind of bullishness will be punished.

ReplyDeleteWell, I see a possible H&S bottom forming on 1.0.3 SPY 30 min chart. We have RS and H now. Is it time for LS? Interesting.