Today is a bearish reversal day, the daily charts of major indices look at least being topped out over the short term, which is quite bearish. However, tomorrow the market might bounce back up and close in green. Here are three reasons to support the potential rally:

- CPC is still lower (or equal to) 0.8 today. Therefore the market has 67% chances to close in green tomorrow according to 7.0.4 Extreme CPC Readings Watch.

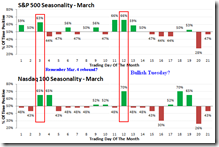

- Statistically tomorrow is the most bullish day in March, and the probability of SPX closing in green is about 66%.

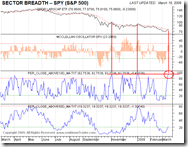

- 1.0.4 S&P 500 SPDRs (SPY 15 min). Oversold, very short-term, especially the ChiOsc is way too low, which also means that the market may bounce back up at least tomorrow morning.

On the other hand, bears should not be too worried if the market does go up tomorrow as the market is still very overbought in the short term. Therefore, if tomorrow high cannot go beyond today's high, maybe the short term reversal gets possibly confirmed, and bears should feel happy about this.

0.0.2 SPY Short-term Trading Signals. Especially NYADV is very overbought, which is my favorite.

Number of SPX stocks closed above MA10 (courtesy of www.sentimentrader.com), still is too high.

1.1.6 PowerShares QQQ Trust (QQQQ 15 min). QQQQ may have formed a Tripe Top. The target is $27.72 which is right at Fib 38.2.

Great TA Cobra. Keep up the awesome work.

ReplyDeleteIf you plot SPX and NYA instead of SPY, you will notice that today's marginal downside had a higher volume than the last three up days. Does that change your opinion of the direction of Tuesday's move?

ReplyDelete"Statistically tomorrow is the most bullish day in March"

ReplyDelete...because of the Treasury paydown from March 15 tax returns.

Not this year. No paydown. Scratch it. Treasury is borrowing another $6 bln this week.

Roxy

Thanks Roxy, I've noticed that this week the big fund may have liquidity problem because of bond sale.

ReplyDeleteARAK, no it won't change my view as today's Russell 3000 Dominant Price-Volume Relationships doesn't show any dominant relationships. Therefore it's like a indecisive day to me. You may want to check my chart 1.3.7 if you haven't read my previous report about chart 1.3.7.

ReplyDeleteHi Cobra,

ReplyDeleteThanks for the great work. If today is the top of the "firework", would you expect this to fall back to where it started (i.e., in the 666 SPX range)?

Pebs, I don't know.

ReplyDeleteLooking like the 5th leg down making new low on SPX.

ReplyDeleteOnce again, the best TA work in the entire blogsphere. THANKS!!!

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteFreaking love your CPC chart!

ReplyDeletehttp://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2393449&cmd=show[s159688408]&disp=P

My personal favorite to share is to look at the last 7 months (daily frequency) of an index using 5,3,3 full stochastics.

The crosses have have been working very well in this market to show near term tops and bottoms.

Very easy to see if you put the stochastics behind the chart in Stockcharts.

Got that baby from www.breakpointtrades.com (love their free newsletter).

Very nice Cobra.

ReplyDeleteI think it will be red today, look at 1.0.3 (30 min) & 1.0.2 (60 min) also gravestone doji is bearish.

ReplyDeleteThe Dreaded.... Triple top

ReplyDeleteRed or Green....place your bets ladies and gents. I check this site several times a week. Without doubt this is one of the best sites for short term or intermediate term signals. Thanks Cobra

ReplyDeleteThanks Cobra. Excellent work.

ReplyDeleteJust found this site -- Fantastic work. Thank you.

ReplyDeleteCan't wait for today's work....

ReplyDeleteRik

I like your writing.

ReplyDeleteInvitation letter

What is your source for the seasonality chart ? If its your own analysis, how many years of history does it use ?

ReplyDeleteThanks

I got it from sentimentrader.com, not sure how many years of history it uses.

ReplyDeleteFree here: http://www.cxoadvisory.com/calendar/