A small candle following a big candle, this is a typical consolidation pattern, so today’s market actions say nothing about the future direction. Short-term overbought signals have been corrected, so I have no idea about tomorrow. CPC is below 0.8, tomorrow the market has 62.5% of chance to close in green according to 7.0.4 Extreme CPC Readings Watch. However this chart has given false signals for three times, so I am not sure if it still works. Over the intermediate term the market is still overbought, therefore a pullback is due in the short-term. The bottom line is that the normalized CPC is too low on 2.8.0 CBOE Options Equity Put/Call Ratio, so I doubt how far this rally can go. Today’s “down” is far from getting back the Monday’s “up”, should the market goes further down tomorrow without fully offsetting Monday’s gain, then I guess there’ll be a new high later.

1.0.4 S&P 500 SPDRs (SPY 15 min). The pattern can be seen as a kiss back after the breakout. STO is a little bit oversold but not at an extreme level, therefore the market could bounce back up during the day if it drops further tomorrow.

3.4.1 United States Oil Fund, LP (USO Daily), possible Bearish Rising Wedge, plus STO overbought, so the crude oil may pull back. 3.4.2 United States Oil Fund, LP (USO 30 min), the bearish rising wedge can be clearly seen on the 30min chart. The pullback of crude oil is bearish to the stock market.

0.0.3 SPX Intermediate-term Trading Signals. Note that the market is overbought over the intermediate term.

T2122 from Telechart, NYSE 4 week New High/Low ratio, overbought. This indicator has been quite accurate once it gets overbought.

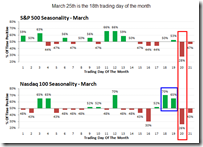

Seasonality, courtesy of www.sentimentrader.com. Just for fun. Tomorrow the Nasdaq 100 seems very bullish as statistically it has 70% chances of closing in green. However Friday looks terrible, will it be a black Friday?

Hi Cobra,

ReplyDeleteHow reliable has the seasonality data been recently in this unique kind of market environment ?

Thanks.

Not very, so I said it's just for fun. For example, We should have a black Monday if this seasonality data worked, but instead we got 500 points up day on INUD. LOL

ReplyDeletenice wedge... you got one right.

ReplyDeleteCobra

ReplyDeleteThanks for your excellent service. How to differentiate this three time frames: Short term (daily chart), intermediate term (daily chart) and a 15 minute SPY chart. Mainly short term and 15 minute SPY.

15 min chart is for intraday trading.

ReplyDelete30/60 min chart is for short-term, a few days.

Chart 0.0.2 in my public list is for short-term because the indicators used in that chart are effective only short-term.

Chart 0.0.3 in my public list is for intermediate-term because the indicators used in that chart are effective for longer period.

Thanks! read your post everyday!

ReplyDeleteCobra

ReplyDeleteVery much appreciate reading your posts everyday, thank you.

Wanted to point out that on chart 0.0.3 that a line from the Nov and Jan highs aligns pretty well with the bottom trend line you have drawn and that there is a resistance zone at around 860 which sets up pretty well with this upper trend line I'm describing.

Thanks for what you do.

ReplyDeleteThanks, I've updated the trend line. That's a typical target when Falling Wedge was broken on the upside.

ReplyDelete