| Trend | Momentum | Comments - Sample for using the trend table. Warning: This is NOT a trading recommendation! | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Up | Overbought | According to $NYA50R, the market might be topped. |

| Short-term | Up | Overbought |

| Report Focused On | Buyable dip or the market topped? |

| Today’s Summary | Expect market continue to pullback tomorrow. |

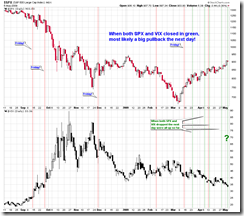

Today both SPX and VIX dropped down. The similar situation happened four times recently, every time on the next day the market closed in green. However CPC is below 0.7 now and this happened six times, while five times the second day market closed in red. Considering the market is still overbought and the seasonality statistics, I tend to believe the market may pullback further tomorrow. However if the market does close in red tomorrow, be reminded that SPX has never closed in red for more than two days in a row since March.

7.0.7 SPX and VIX Divergence Watch. This supports the market going up tomorrow.

2.8.1 CBOE Options Total Put/Call Ratio. This supports the market going down tomorrow. Furthermore, because CPC < 0.7, the firework trading setup should has finished today according to 2.8.3 SPX:CPCE.

1.0.2 S&P 500 SPDRs (SPY 60 min). There are still six gaps, still overbought and negative divergence, therefore still I dare not add any long positions.

T2103 from Telechart, Zweig Breadth Thrust, still overbought.

T2121 from Telechart, 13 Week New High/Low Ratio, rallied again and still due for a pullback.

T2112 from Telechart, % stocks trading 2 standard deviation above their 40-day moving average, still too many stocks deviated from MA40, although it has been corrected a bit today, it is still a multiple-year new high.

Seasonality from www.sentimentrader.com, the following two days are probably the most bearish days in May.

2.0.0 Volatility Index (Daily). Note STO and MA ENV, VIX may bounce back up which is bearish to the stock market.

OK, now something about “useless” TA as I’ve been repeatedly hearing.

0.0.3 SPX Intermediate-term Trading Signals. This chart is prefixed with “0” in my chart book and considered as one of the most important charts. If you simply follow the MACD or NYSI on the chart, you may pocket the profit from the very beginning to the very end. This is so called Let the market go first. Well, I’m merely a human so I did a few attempts of running before the market and yes, got burnt several times, but fortunately, I always leave some fund for letting the market go first. Trend following indicators such as MACD and momentum indicators such as STO are designed for different market conditions, there is no single indicator which covers everything.

7.3.1 Simple SDS Trading System. This chart has been working pretty well in the past, now it says to buy SDS which means to short the market. OK, tough question here: WILL YOU FOLLOW? You are scared, aren’t you? What I am trying to say is there is no 100% guaranteed indicator, you have to rely on good trading strategy and long term success rate to win the game. Think about how many people dared to long when MACD on chart 0.0.3 gave a buy signal on Mar 12?

Didn't realize $SPX has not closed in the red two days in a row since March.

ReplyDeleteNo more than 2 days. I've corrected. :-)

ReplyDeleteCobra,

ReplyDeleteThere is a loophole in your logic about both SPX and VIX going down and the next day ends in green. It simply depends on where they are. Your other chart on Stoc and RSI of VIX actually exposes this issue. SPX is just turning red and VIX has been red for a long time. Therefore you know the rest....

2c

So, This is easy....

ReplyDelete900 vs a new high...

we closed 903. we could gap lower, and 900 may act as resistance.

But... if we get a new high on the morning buying, Short it.

Else

if we look like we are going to retest 900 It should Fail.

We have retested it 2 times without a new high.

then we should be looking at a 200-300pt decline and then we will get a failed bounce, as the "Buy the Dip" folks provide resistance, and get blown out.

Eric: do you not understand the difference between support and resistance?

ReplyDeleteCobra: please share your response to 2cents comment.

2cents: thank you for being a little more polite in your comment today.

This market seems like a bucking bronco that is just trying to shake us off before going higher.

ReplyDeleteAnonymous, thanks, but I really don't know how to "response to 2cents comment". I think we think things differently. 2cents has his point, but I'd rather report statisitcs and let readers decide whether to listen or not to.

ReplyDeleteCobra,

ReplyDeletethe reason you will never get a "Good" forum going... is because there is no reason why anyone would waist their time.

ok... here you go.... I looked it up for you:

Support Equals Resistance

Another principle of technical analysis stipulates that support can turn into resistance and visa versa. Once the price breaks below a support level, the broken support level can turn into resistance. The break of support signals that the forces of supply have overcome the forces of demand. Therefore, if the price returns to this level, there is likely to be an increase in supply, and hence resistance.

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:support_and_resistan

even gave you a footnote.....

Eric, I'm not sure if I understand you correctly. Just I really don't have time to run a forum, so sorry for all kind of slow responses.

ReplyDeleteJust saying, "a forum is a waist of your time.".

ReplyDeleteThe other part was a responce to anon.

Well, that should crack the bear's spine... but can't eliminate an intra-day high tomorrow..

and better to catch it on the downside.

correlations are back to '1' again.... so... caution still, we will see what happens by the bell.

I think I win.... Do I get a Prize?

ReplyDeleteEric, I don't get you. Are you expecting an intraday new high tomorrow?

ReplyDeleteThese Feel like "THE Highs"

ReplyDeleteI can't guarantee anything.

So;

Maybe we gap down and start selling,

maybe Dome top tomorrow morning.

and Maybe I'm wrong.

I don't Expect an intra-day high, but I can't Rule it out, and with the way it closed there would seem to be a solid chance.

The worst part is that every moron is short the banks, and they just can't go down.

We closed near the highs, so futures will probably be negative in the morning.

I see high likely a gap up open tomorrow morning and 65% chances of close in green according to CPC readings today. There're still a few people in my Chinese forum are calling top, so I'm still not sure. But anyway, I dare not chase high at this level now.

ReplyDeleteCould be... Market is cruel....

ReplyDeleteI'm trying to understand how the Daily Vix could get any more oversold. Will it go off the chart?

ReplyDeleteI hate saying anything, because I don't have the energy to go into massive detail.

ReplyDeletebut with indicators right now, when you are in the '30 year flood' or '100 year flood' one should expect them to get extreme. So when you see extreme indicator, it needs to be extreme in the context of a 30 or 100 year flood extreme.

So we need indicators in that kind of that extreme, on a relative basis, and they have manged to get there finally... but can get worse.

Though Cobra's Chinese forum has top callers, one problem is when you have 1,000 monkeys, sometimes they get it right.

this could run all the way to a 'false breakout' of the Jan High, but that is only 30 spx pts away at this point.

but Just keep trying to sell strength, and take profits.... but don't sell into weakness, sell into strength.

today had a funky feel to it... seems like everyone was drooling on themselves ... nobody knows what to think anymore.

and... a good top will take some time...

bla bla bla bla

;)

But, in the morning... I'll look to sell some nice dome top. The interesting thing is that "For sure" the market doesn't want to hold a gap anymore.

maybe we will get some kind of bull trap above the 920...

bla bla bla

GYOFB

Eric, I think you might be right although my "source" told me tomorrow the market may write a big V, therefore very likely closes in green eventually.

ReplyDelete