Summary:

Bearish reversal day since March mostly led to a further pullback.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Up | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | 11/30 L | *Adjust Stop Loss | 12/03 Low |

|

| Reversal Bar | 11/30 L |

| Breakeven |

|

| NYMO Sell | *Short tomorrow if Open > Close. |

| ||

| VIX ENV | ||||

| Patterns ect. |

INTERMEDIATE-TERM: BUILDING A TOP

Maintain the “building a top” forecast. For details please see 11/27/2009 Market Recap.

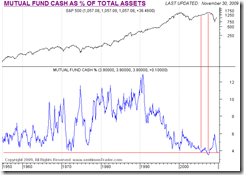

As mentioned in yesterday’s report, the most recent Investor's Intelligence Sentiment Survey shows the 3rd record low number of bearish newsletters. Today, let’s take a look at the sideline money, although not extremely low but at least not like what people have believed: too much money waiting on the sideline or fund managers are worried about their annual performances.

SHORT-TERM: VERY CLOSE TO A TOP

Blue cycles below, look at what had happened since the March, whenever SPY opened with an up gap then closed in red? Plus the black bar I mentioned yesterday on chart 1.1.3 QQQQ Short-term Trading Signals, so very likely, a little bigger pullback is very close.

About tomorrow, After Bell Quick Summary is bearish, but bulls may have a chance, 3.1.0 PowerShares DB US Dollar Index Bullish Fund (UUP Daily), the black bar could mean that dollar would pullback. Anyway, whether up or down tomorrow is not important as I think sell bounce should be the name of the game now.

INTERESTING CHARTS: NONE