Summary:

Don't see any short-term negative divergence, so short right here maybe a little premature.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Up | Neutral | II Survey: Historical low number of bears. | |

| Short-term | Up | Neutral | 0.0.9 CPC/CPCI: Topped? | |

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals, details are HERE. Take profit whenever you see appropriate. |

| ST Model | 12/21 L |

| Breakeven | |

| Reversal Bar | 12/21 L |

| Breakeven |

|

| NYMO Sell |

| |||

| VIX ENV | ||||

| Other Signals | 12/28 S | *Short at close. | 2xATR(10) | 2% stop for SPY, 4% for 2xETF. |

INTERMEDIATE-TERM: BREAKOUT BUT I'M NOT CONVINCED

Nothing new, breakout but I'm not convinced, see 12/24/2009 Market Recap for more details.

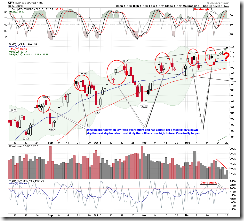

SHORT-TERM: COULD BE A PULLBACK SOON

As mentioned in the After Bell Quick Summary, a short setup was triggered because of the SPY black bar. Just that reason may not be good enough. Better wait for a negative divergence formed on chart 1.0.3 S&P 500 SPDRs (SPY 30 min). In another word, to trade against a trend, better take the 2nd entry, in our case is to wait the market pullback then rebound to test the previous high then short the pullback.

3.4.1 United States Oil Fund, LP (USO Daily), black bar so oil could pullback which is not good for the stock market.

6.4.5 GLD and UUP Watch, black bar too, so UUP could be up tomorrow at least gaps up, this also is not good for the stock market.

INTERESTING CHARTS: NONE