SHORT-TERM: WE MIGHT HAVE ONLY ONE DOWN DAY UNTIL FOMC

Nothing to say today, as per the 7 days rule, today should be the only red day before the FOMC Wednesday, so if red again tomorrow, then it only proves again that so far we have (had) is (was) just a rebound.

- I have no idea about whether up or down tomorrow.

- I’m bearish biased on the big picture.

- But for the short-term, I’d long if I see good setup. (Well, I know this is a nonsense as I’d short if I see good short setup too, I just mean I’m not bearish on the short-term yet)

Really hard to find something interesting to say today, the charts below are just to make sure I never miss a single report for the past 4 years, so kind of must say something kind of report today.

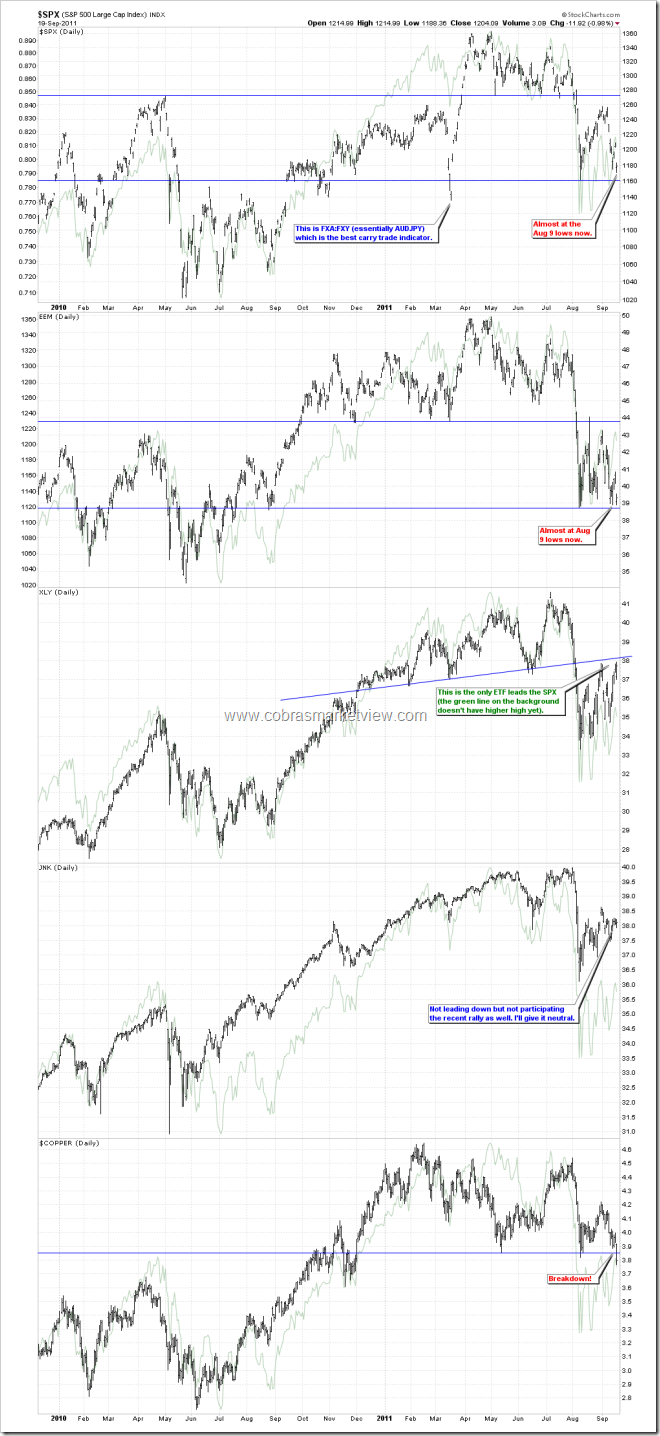

Except XLY, all the other most commonly watched leading ETFs are leading down. Especially copper, had a breakdown today. When the market was bullish, everyone’d like to remind that the copper led up, now why didn’t I see everyone mentioning that copper leads down?

I think an exhaustion bar is formed on the AAPL daily chart, so could see a pullback of some kind soon which should imply that QQQ won’t be good. Just look at what happened in the past when ChiOsc was way too high.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

See 08/19 Market Outlook for details.

SEASONALITY: BEARISH WEEK

According Stock Trader’s Almanac, week after September Triple Witching, Dow down 16 of last 20, average loss since 1990, 1.1%.

See 09/02 Market Outlook for September seasonality.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

| ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

|