SHORT-TERM MODEL SEES A DOWNTREND, HOLDING SHORT POSITION OVER THE WEEKEND

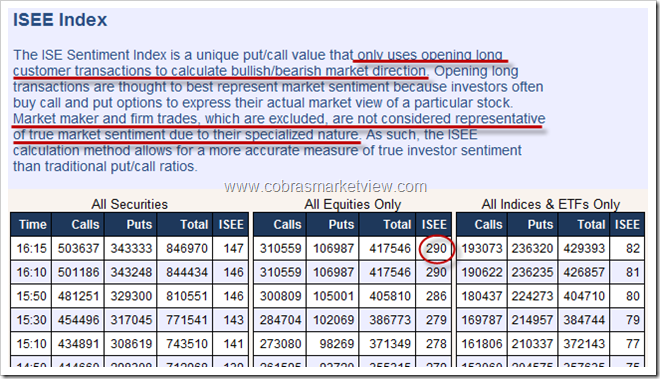

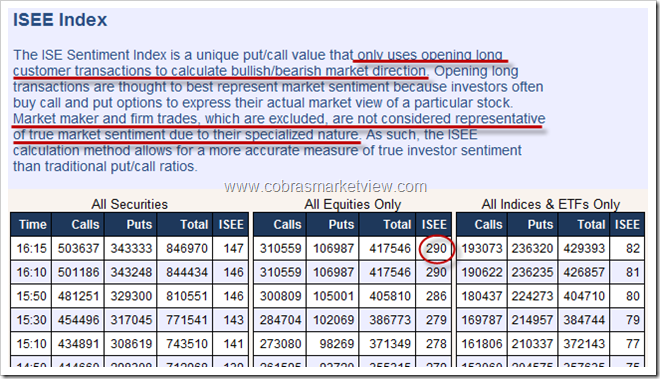

The bottom line, as mentioned in the close statement of today’s intraday comment, I don’t know why retailers are so bullish going into the weekend as ISEE Equities Only Index reading at 290 is very rare and extremely high, meaning bulls to bears ratio is 2.9:1. Since people keep asking why I think it’s retailers, so I also highlighted the description of the ISEE index from the official ISEE web site, should be clear why…

The long setup of the Cobra Impulse System wasn’t confirmed today but the system is still trying to buy the dip the next Monday. And also there’s a potential short setup for the next Monday too. See table below for more details.

Enjoy your weekend!

| MECHANICAL TRADING SIGNALS |

| SPY SYSTEM | ENTRY | STOP LOSS | Current 2*ATR(10) value: SSO=12%; SDS=10%; UPRO=18%;SPXU=15% | | Non-Stop | *09/23 S | N/A | *Closed long opened on 08/25, short position initiated. | | Cobra Impulse | | | *Long if above 09/23 high and close in green Monday. Stop loss = 1.7*ATR(10)

*Short if below 09/23 low and close in red Monday. Stop loss = 2.0*ATR(10) | |

| DEMO ACCOUNT FOR SHORT-TERM MODEL (Attention: This is not part of Cobra Impulse System) |

| TICKER | Entry Date | Entry | Share | Stop Loss | Exit Date | Exit | Profit | Comment | | SDS | 09/23/2011 | $25.44 | 100 | $22.90 | | | | New strategy, half positioned for risk $500 max. | | SSO | 09/20/2011 | $43.68 | 50 | $39.31 | 09/20/2011 | $44.06 | 19.00 | | | SSO | 09/15/2011 | $43.00 | 50 | $38.27 | 09/15/2011 | $43.53 | 26.50 | | | SSO | 09/14/2011 | $41.45 | 50 | $39.31 | 09/22/2011 | $38.09 | -168.00 | Gap down, manual stop loss used. | | SSO | 09/13/2011 | $40.51 | 50 | $35.65 | 09/13/2011 | $40.88 | 18.50 | | | SDS | 09/13/2011 | $24.03 | 100 | $21.39 | 09/22/2011 | $26.25 | 222.00 | | | SDS | 09/02/2011 | $24.35 | 100 | $21.43 | 09/13/2011 | $23.48 | 3.00 | | | SDS | 09/01/2011 | $22.94 | 100 | $19.96 | 09/01/2011 | $23.01 | 7.00 | | | SSO | 08/30/2011 | $44.09 | 50 | $38.69 | 09/12/2011 | $38.69 | -270.00 | Gap down, manual stop loss used. | | LAST | | | | | | | 2935.00 | | | SUM | | | | | | | 2793.00 | | |

- $500 max loss allowed per trade. For fun only.

- LAST = Year to the last month balance. SUM = Year to date realized gains/losses.

|

Disclaimer

The information contained on this website and from any communication related to the author’s blog and chartbook is for information purposes only. The chart analysis and the market recap do not hold out as providing any financial, legal, investment, or other advice. In addition, no suggestion or advice is offered regarding the nature, profitability, suitability, sustainability of any particular trading practice or investment strategy. The materials on this website do not constitute offer or advice and you should not rely on the information here to make or refrain from making any decision or take or refrain from taking any action. It is up to the visitors to make their own decisions, or to consult with a registered professional financial advisor.

This websites provides third-party websites for your convenience but the author does not endorse, approve, or certify the information on other websites, nor does the author take responsibility for a part or all materials on the third-party websites which are not maintained by the author.