SHORT-TERM: COULD SEE MORE REBOUND BUT MORE LIKELY THE LOW WASN’T IN YET

As mentioned in today’s Trading Signals, I cannot exclude the possibility that the high was in today. That said, it’s not prudent to call so merely because of a filled black bar and a hollow red bar, so need see tomorrow. If however, another filled black bar or hollow red bar or Doji, then bulls really need to be careful because 2 reversal like bars in a row are much more reliable. The charts below should be clear enough why I cannot exclude the possibility that the high was in, especially the subtle divergence between SPX and VIX.

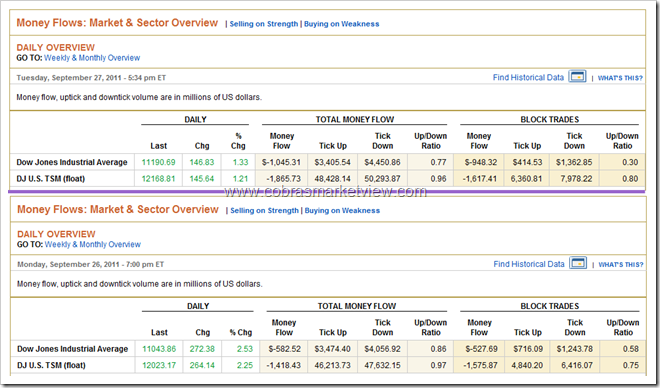

Except the reversal like bars mentioned above, we had a 2%+ up yesterday and as high as 3%+ today, but both days saw very negative Money Flows which is suspicious. I didn’t mean that because of the negative money flows so the market would drop immediately but certainly we should pay attention here.

I’m sure some would ask, since today’s rebound was the strongest where c > a and c > b, so does it prove that the trend has been changed to up from down? All I can say are this is the very first step, certainly a good sign, but there’s still a long way to go. The next, we may want to see whether bears could prove themselves, so again, let’s wait and see.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

See 08/19 Market Outlook for details.

SEASONALITY: BEARISH FRIDAY

According Stock Trader’s Almanac, last day of Q3, Dow down 9 of last 13, massive 4.7% rally in 2008.

See 09/02 Market Outlook for September seasonality.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

| ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

|