I don't have much to say today. If you have some time you may check out TK's video. My feeling is similar with his, i.e. quite bearish to the market, although many technical indicators have shown that the market has deeply oversold. Uncertainty is what most investors dislike, given the situation that no one knows how many regional banks could go bankrupt, investors are reluctant to put their money into the market. As a result of this, I doubt if we could see any sustainable rally in the near term. Of course, since so much uncertainty is ahead of us, I would not be surprised if the opposite thing happened. Should you wish to get further insight, you may like to read this article concerning the issue of regional banks, basically those highly risky banks are mostly located at those regions where the housing price skyrocketed.

The following chart shows the Bank Index which is almost free falling. The current price level is in the region where $BKX went up quickly without much consolidation, the support will be close to none.

Here is XLF. Not so far from the all time low, and there is no reason it will not reach there. (Note: I checked other data sources and it seems now it is The all time low).

Summary: as J. Murphy reported today, as has been suggested herein many times, the market decline is likely to continue until the financial sector stabilizes. So far, there's no sign of that happening.

You may ask, what will it happen tomorrow? I am sorry to tell you that most likely falling down continues. Reasons are two:

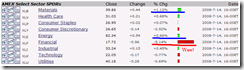

- XLE and XLB were the strongest two sectors to support the market today. This doesn't sound good because both are inflation related. Another two "bullish" sectors were XLP and XLV which are so called defensive sectors. This means the money fled to safety, no good.

- Concerning the Russell 3000 dominant price-volume relationships, 1491 stocks were price down volume down, which means no panic, in other words, this is a continuation pattern.

1.0.0 S&P 500 Large Cap Index (Daily), 1.1.0 Nasdaq Composite (Daily), 1.1.6 PowerShares QQQ Trust (QQQQ Daily), 1.2.0 Dow Jones Industrial Average (Daily). The candlestick patterns on those major indices are quite bearish today, and the only hope is that the last Friday low still holds.

2.0.0 Volatility Index - NYSE (Daily). Now it is overbought, and RSI(14) is sitting at the key resistance, so it may pull back. As aforementioned analysis points out, I am not sure if the market will rally on the pullback of VIX.

2.0.2 Volatility Index 30-day/90-day Ratio. Excellent! It has spiked into a bullish region. However, the trend of the market may not reverse before this signal reaches an all time high.

3.3.0 StreetTRACKS Gold Trust Shares (GLD Daily). Now it is overbought.

great work, as always.

ReplyDelete