Recently there is a pattern that if one day the market plunges, it probably will not plunge again in the second day. You may verify this on a daily chart of any index (note: it is index, not ETF), in fact the market rarely sells off for two consecutive days. If this pattern is still valid, tomorrow we may see a rebound. Both SPX and INDU are oversold, but Breadth is not although it is not far away from oversold region.

The Russell 3000 Dominant Price-Volume Relationships are 1429 stocks price down volume down, 1012 stocks price down volume up. This means the overall market is actually not oversold yet.

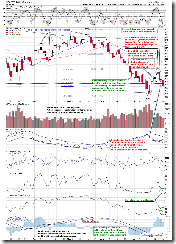

0.0.1 Simple SPY Trading System. STO is oversold, and SPY is pulled back to Fib 61.8. According to the trading rules, long positions should not be initiated today because there is no reversal candle. Note the RHNYA and NYA50R are close to oversold region, this means it is probably fine to try a little bit of long positions providing that the market goes down tomorrow.

1.2.0 Dow Jones Industrial Average (Daily). Note that STO is at a very low level, and tomorrow $INDU has a high possibility of bouncing up.

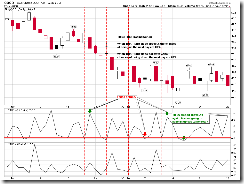

1.1.C TRINQ Trading Setup. Tomorrow QQQQ will likely go up since TRINQ closed above 2.0.

0 comments:

Post a Comment