Today is the fourth day I gave the wrong prediction. Many people have been talking about that TA seems useless at the moment because the economy is in such a bad shape. However, I still believe that a bottom is pretty close. Of course, I have kept saying that bottom fishing is against the trend, and one should be cautious and always keep some cash no matter how sure you are. Hopefully you still have some bullets left now. I believe that, the current situation is like a pressed spring, once the market bounces back up, the probability of seeing a major accumulation day is very high. Keep in mind that a major accumulation day has shown up before, opening long positions after two major accumulation days is proven to be safe and profitable according to the past data.

The market might go up tomorrow, in my opinion. The reason is still oversold.

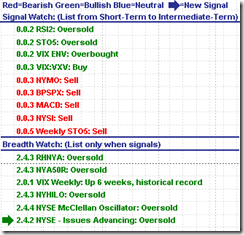

0.0.0 Signal Watch and Daily Highlights. The last signal on my watch list is oversold too, so there is no signal which is not in an oversold status -- except for no mid-term buy signal.

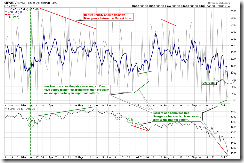

2.4.2 NYSE - Issues Advancing. This is the only good news today. As I mentioned yesterday, no matter what, NYADV should not form a lower low, otherwise SPX may have a lower close which is lower than today's close. So far no lower low happens. I don't know if or not it will form a lower low tomorrow. But the market may bounce back while NYADV gets oversold. Look at the following chart, every time the blue curve reaches the green horizontal green lines (denoted by green dashed line), the market always bounces back. In this year this pattern is always right. Hopefully this time is no exception, and TA still works.

1.0.5 Major Accumulation/Distribution Days. Today is another major distribution day. According to the patterns on the chart (note the places marked by green circles and blue dashed lines), the market will have a nice rally after 2-3 major distribution days. However, we should be cautious because there are only two major accumulation days so far, and the third one could come. Take notice that prior to the big rally on Sep 18th/19th there were 4 major distribution days.

1.0.4 S&P 500 SPDRs (SPY 15 min), 1.1.5 PowerShares QQQ Trust (QQQQ 15 min), 1.2.4 Diamonds (DIA 15 min), MACD and RSI show positive divergence, which is an early sign of rally.

Cobra,

ReplyDeleteMy compliments on your analysis, which is most insightful.

I noticed today that when I load your png chart files to a separate page, that the image size has reduced and its graphic resolution has gone down. I just wanted to let you know, in case it might be easy to restore these to the size and resolution they had previously.

In any case, your work is most appreciated.

Regards,

AKA_CES

Thanks. I've corrected all of them.

ReplyDeleteThank you!

ReplyDeleteAKA_CES