The bottom line, the VIX ENV/BB buy setup and the Reversal Bar buy setup were triggered today which mean short-term up. But for the intermediate-term, I see no evidence that the trend has been changed yet, so still maintain the down predication.

I see 2 tricks today. One points to a red day tomorrow and the other a green day tomorrow.

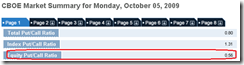

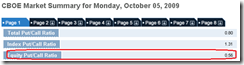

CPCE <= 0.56, 19 out of 27 cases (70%) a red day the next day.

When ISEE Indices & ETFs Only Index < 50 and ISEE Equities Only Index > 160, 8 out of 13 cases (62%) a green day the next day.

According to the past few cases when these 2 tricks conflicted, it seems that CPCE has a higher priority therefore a red day tomorrow is a little bit more likely.

Disclaimer

The information contained on this website and from any communication related to the author’s blog and chartbook is for information purposes only. The chart analysis and the market recap do not hold out as providing any financial, legal, investment, or other advice. In addition, no suggestion or advice is offered regarding the nature, profitability, suitability, sustainability of any particular trading practice or investment strategy. The materials on this website do not constitute offer or advice and you should not rely on the information here to make or refrain from making any decision or take or refrain from taking any action. It is up to the visitors to make their own decisions, or to consult with a registered professional financial advisor.

This websites provides third-party websites for your convenience but the author does not endorse, approve, or certify the information on other websites, nor does the author take responsibility for a part or all materials on the third-party websites which are not maintained by the author.