Summary:

Could be more short-term pullback.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Up | Neutral | No argue | NYSI not confirming the up trend. |

| Short-term | Up | Neutral | Yes! | |

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | 10/14 L | 10/06 Low | ||

| Reversal Bar | 10/05 L | 10/13 Low | ||

| VIX ENV | 10/06 L | *Adjust stop loss | *10/16 Low |

|

| NYMO Sell | *Must be a red day next day to confirm the sell signal | Winning Rate: 59%, Gain/Loss Ratio: 4.9 | ||

INTERMEDIATE-TERM: NO UPDATE

Nothing new. Maintain the target mentioned in the chart 1.0.8 SPX Cycle Watch (Weekly). Still worried about 2 things:

- 1.1.0 Nasdaq Composite (Daily), too many unfilled gaps.

- 1.2.1 Dow Theory: Averages Must Confirm, breadth is way overbought and INDU new high not confirmed by TRAN.

SHORT-TERM: COULD BE MORE SHORT-TERM PULLBACK

0.0.3 SPX Intermediate-term Trading Signals, inspired by this article: 10-Day Trading System, see vertical lines in the chart, the 10 day cycle worked so far so good which could mean a pullback next week. Will we get again the 20 day straight rise like July? Personally, I think it’s unlikely. Two reasons:

1. 8.1.5 Normalized CPCE, way too low. Although it hasn’t reached the past extremes yet, but at least it does not support a big rise. Look at the CPCE in July, it was not that low like now.

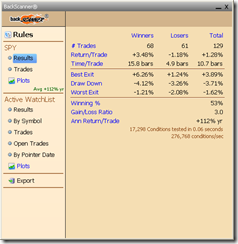

2. 6.4.0 SPX and NYMO Divergence Watch, while SPX is still around the new high but NYMO has already given the sell signal. This chart so far worked OK. From the visual back test below we can see that the winning rate is not good, the key is to cut loss within couple of days. The reward, sometimes is very good, catching exactly the market top.

INTERESTING CHARTS:

The bottom line, see here: EPS Beat Rate at 85%,Guidance – Wow, looks like nobody is expecting a bad ER anymore. But just take a quick look at what happened after some of heavy weight stocks reporting a “beat” ER. If the trend of “sell on news” keep going on, better not to be too bullish.

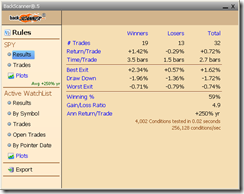

I added some “buy dip/sell bounce” stuff into my ST Model. The link is here: Introducing Mechanical Trading Model. Below is the updated back test summary. Again it’s for fun only.