Summary:

CPCE intermediate-term top signal was invalidated today.

Not closed above resistance, still maintain the intermediate-term down forecast.

Around 1500 stocks in Russell 3000 index up on decreased volume is short-term bearish.

VIX ENV/BB setup triggered for short-term long.

| TREND | MOMENTUM | COMMENT - Sample for using the trend table. | ||

| Long-term | Up | |||

| Intermediate | Down | Neutral | ||

| Short-term | Down | Neutral | ||

| SETUP | DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| Index ST Model I | Stopped out long with gain on 10/01. No position held now. | |||

| Index ST Model II | 10/05 | *Move stop loss | 09/30 High | Short position initiated on 09/30. |

| VIX ENV | 10/05 | *Buy next open | Stop loss will be in tomorrow's report | |

| Reversal Bar | 10/05 | *Buy intraday | Stop loss will be in tomorrow's report | |

INTERMEDIATE-TERM: MAINTAIN DOWN FORECAST

The bull’s achievement was that the 2.8.0 SPX:CPCE top signal was invalidated. But it also left a 10th unfilled gap on 1.0.2 S&P 500 SPDRs (SPY 60 min). Also because SPY was not decisively closed above its first major resistance, so I have no conclusion today and also therefore no changes in the trend table above.

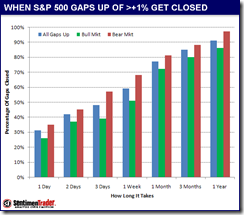

The chart below is from www.sentimentrader.com explaining why I keep counting the unfilled gaps on the SPY chart – Because statistically 80% chances a 1% (or above) gap should be filled within 3 months. Now, SPY has 7 1% (or above) unfilled gaps and most of them are more than 3 months old.

Today’s Ressull 3000 Dominant Price-Volume Relationships is 1510 stocks “price up volume down”. From the chart below we can see if price up volume down count is around 1500, very likely a red day the next day. Well, there’re also 2 cases, the market shot up much much higher thereafter. So which history will we repeat, we’ll know soon.

SHORT-TERM: VIX ENV/BB BUY SETUP TRIGGERED

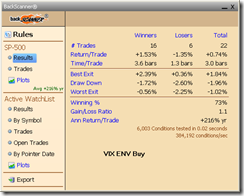

6.2.0a VIX Trading Signals (ENV), 6.2.2b VIX Trading Signal (BB), I talked about these 2 setups on Thursday, and today they’re triggered. I’ve included the back test summaries since 2002 below for your reference. The pre-condition for the back test is that my Index Swing Trade Mode I is not on “sell” signal.

The Reversal Bar trading setup mentioned in the weekend report was triggered too. Theoretically you could long today intraday once you saw a good chance to close in green.

As for the stop loss for the above setups are: held tomorrow at least then use the low today or tomorrow (whichever is lower) as the stop loss point. Personally, I still think they’re risky trades at the current stage, so be careful.

INTERESTING CHARTS: NONE