Summary:

"Pair" indices led the breakdown which is bearish for intermediate-term.

Short-term is very oversold, expect a rebound soon.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Down | Neutral | ||

| Short-term | Down | *Oversold | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | Stopped out with loss on 10/26 | |||

| Reversal Bar | Stopped out with gain on 10/21. | |||

| NYMO Sell | 10/21 S | Break even | Hey, I'm merely a machine. I don't know how to take partial profit but as a human being, you should smart enough to know when to take partial profit, right? | |

|

| ||||

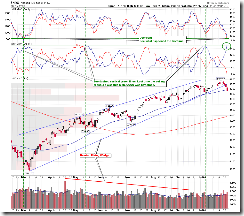

INTERMEDIATE-TERM: "PAIR" INDICES LED THE BREAKDOWN

Take a look at the chart below, a few leading indices led the breakdown. I consider them as intermediate-term bearish and expect SPY and QQQQ to follow soon.

2.8.0 SPX:CPCE, trend line still held. No need to explain more about this chart, do I?

SHORT-TERM: VERY OVERSOLD

I won’t put many charts here today as the oversold signals are everywhere. The question is when there’ll be a rebound and if this is a buyable dip. I don’t know when there’ll be a rebound, could be tomorrow the earliest. As for whether to buy this dip, personally without any short position as insurer, I won’t buy this dip.

The following chart shows 2 oversold signals I think worth of watching. For other so so oversold signals, no bother to mention here. Take a look at 0.0.2 SPY Short-term Trading Signals, if you have time, all indicators are oversold now. By the way, I’ve noticed that still some readers are unaware that all the charts I mention here are in my public list at www.stockcharts.com. It’s a very good collection of indicators worth of watching by yourself even most of them I do not mention everyday.

1.1.4 Nasdaq 100 Index Intermediate-term Trading Signals, this chart also needs your attention. Look at NADNV (Nasdaq Down Volume), as it usually means a bottom!

INTERESTING CHARTS:

3.4.2 United States Oil Fund, LP (USO 30 min), could be a Head and Shoulders Top.