TREND INDICATOR MOMENTUM INDICATOR COMMENT (Click link to see chart) Long-term 3 of 3 are BUY Intermediate 3 of 3 are SELL 6 of 6 are NEUTRAL SPY ST Model is in SELL mode Short-term 1 of 1 are BUY 8 of 8 are NEUTRAL

BULLISH 0.0.6 Nasdaq 100 Index Intermediate-term Trading Signals: NADNV too high. BEARISH 2.0.0 Volatility Index (Daily): Could be a Bull Flag in the forming. CONCLUSION

SPY SETUP ENTRY DATE STOP LOSS INSTRUCTION: Mechanic signals, back test is HERE, signals are HERE.

TRADING VEHICLE: SSO/SDS, UPRO/SPXUST Model 01/27 S *Stopped out of short position flat. Reversal Bar NYMO Sell 01/21 S *Stopped out of short position with gain. VIX MA ENV

OTHER ETFs TREND COMMENT – *New update. Click BLUE to see chart if link is not provided. QQQQ IWM CHINA Down Double Top or Bearish 1-2-3 Formation? EMERGING CANADA Down Double Top, target $15.77. FINANCIALS REITS ENERGY OIL GOLD DOLLAR UP Confirmed Head and Shoulders Bottom breakout. BOND Could be a Bull Flag. So yield could rise while bond should fall.

INTERMEDIATE-TERM: INITIAL SPX PULLBACK TARGET COULD BE AROUND 1020-1040 AREA

No update, according to chart 4.1.0 S&P 500 Large Cap Index (Weekly), the most likely initial pullback target could be around 1020-1040 area.

SHORT-TERM: THERE’S A CHANCE THE REBOUND IS NOT MERELY A REBOUND

I still have no evidence to call a bottom, so has to treat the 2 days rally as an oversold rebound (well, not oversold anymore). However, the good news is 7.1.0 Use n vs n Rule to Identify a Trend Change, for equally down 2 days vs up 2 days, apparently bulls won, so there’s a chance that the rebound is not merely a rebound. The key is that the market must keep rising for several more days because according to the most recent pattern, see chart 0.0.3 SPX Intermediate-term Trading Signals, if indeed SPX was bottomed, there shouldn’t be any VISUALBLE pullback on the daily chart, while instead, it should simply keep rising day after day, let’s see.

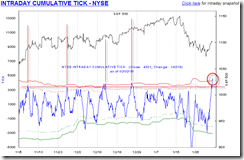

As mentioned in today’s After Bell Quick Summary, because ChiOsc in chart 1.0.2 S&P 500 SPDRs (SPY 60 min) is way too high, so expect some weakness at least tomorrow morning. Here’s another reason, NYSE Intraday Cumulative TICK is too high.

The bottom line, very short-term is very overbought now, so it’s reasonable to expect a little bit weakness (at least intraday), as long as it’s not a big pullback then chances are higher and higher each day that we may see a new high.

1.0.3 S&P 500 SPDRs (SPY 30 min), take a look, SPY reached the 2nd target at Fib 38.2% I mentioned in yesterday’s report, the next target would be the Jan 22 gap.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in SELL mode, only SHORT candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Today’s screener has only one stock – ODFL, look familiar? Yeah, it was the chosen one last Friday but was not confirmed on Monday, guess it has to die first then someone must say “I love you” to wake it up to be a chosen one? LOL

According to the entry rule, the only stock found yesterday was not confirmed.