| ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

|

INTERMEDIATE-TERM: IN WAIT AND SEE MODE

See 02/19/2010 Market Recap, not sure about the market direction, in wait and see mode.

SHORT-TERM: EXPECT MORE PULLBACKS, UP DAY TOMORROW MAY JUST DEALY THE INEVITABLE

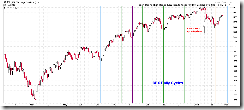

The sell off today may not mean anything yet. How the market close tomorrow is more important. See chart below: According to the most recent pattern, after a black bar followed by a big red bar, if SPY could close in green the next day, then most likely there’ll be a new recovery high.

1.0.2 S&P 500 SPDRs (SPY 60 min), both SPY and QQQQ are now on multiple supports, so there’s a good chance that the market may close in green tomorrow.

However, if indeed we see a rebound tomorrow and the market even reaches a new recovery high thereafter, better take the chance to reduce long positions because even according to the “black bar followed by big red bar” pattern mentioned above, eventually there’re more pullbacks. Besides, there’re some other reasons.

As mentioned in today’s After Bell Quick Summary, chart 6.4.7 NYSE Tick Watch (60 min), SPY dropped more than 1% but there’s no single -1,000 TICK readings, this means an orderly retreat which the past few cases always led to more pullbacks thereafter.

0.0.8 SPX:CPCE, breakout of 3 points validated trend line is quite a reliable top signal.

The chart below was mentioned by The_Grim_Reaper in comment area. He found that the last 3 trading days were generally bearish for the last 6 months.

And lastly, don’t forget 1.0.7 SPX Cycle Watch (Daily) and 1.0.8 SPX Cycle Watch (Moon Phases) – the full moon on Feb 28. March 1st is the closest cycle due date, if the market rises to that date then it’ll be a cycle top. Of course, if the market keeps dropping until the March 1st, then it’ll be a cycle bottom which, by the way, best fits what 0.0.8 SPX:CPCE actually predicts.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Since the intermediate-term direction is not clear, so no stock screeners from now on until the dust settles.