| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: MONDAY AND FRIDAY ARE BULLISH

See 04/30 Market Recap for more details.

CYCLE ANALYSIS: COULD BE A CYCLE TOP AROUND 05/03 TO 05/10

See 04/30 Market Recap for more details.

INTERMEDIATE-TERM: EXPECT ROLLER COASTER AHEAD OR THE MARKET COULD BE TOPPED

See 04/30 Market Recap for more details.

SHORT-TERM: MIXED SIGNAL, A LITTLE BULLISH BIASED THOUGH

Not sure about the short-term direction, need see tomorrow. For the intermediate-term see 04/30 Market Recap, the market could be building a top of some kind. In another word, I’m not sure if the market still has a final push up left.

0.1.0 SPY Short-term Trading Signals, from bull’s eyes, could be a Symmetrical Triangle in the forming, which could mean a wave 4 and therefore could be a wave 5 final push up ahead. The potential target for the wave 5 (if so) could around SPX 1250ish.

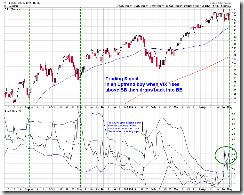

0.1.1 SPX Intermediate-term Trading Signals, from bear’s eyes, could be a Diamond Top in the forming plus a big Ascending Broadening Wedge.

Whether it’s a Symmetrical Triangle or a Diamond Top, need see tomorrow. My bias lean to the Symmetrical Triangle, the excuse is the chart 6.2.2b VIX Trading Signal (BB), the VIX BB buy setup triggered today. See the back test, buy tomorrow open, sell at the 4th day close, bull has 75% chances.

If the market rises again tomorrow, pay attention to today’s WOW. Again Nasdaq had almost no minus TICK the whole day today. The previous 3 WOWs were on 04/29 Market Recap, 04/20 Market Recap and 04/14 Market Recap. However the WOW today is the smallest comparing with the previous 3 WOWs, so I’m not sure if it’ll have the same dramatic effects as the previous 3 WOWs.