| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals.

SEASONALITY: MONDAY AND FRIDAY ARE BULLISH

See 05/14 Market Recap for more details.

INTERMEDIATE-TERM: MAINTIAN PULLBACK TARGET AROUND 1008 TO 1019

- For the price target, maintain the forecast for pullback to around 1008 to 1019, see 05/14 Market Recap for more details.

- For the time target, also maintain the time window between 05/19 to 05/22 (since 05/22 is weekend, so 05/24 also counts), see 05/07 Market Recap for more details.

- Between the price target and the time window above, the price target should weight more. Because the 05/19 to 05/22 time window is the minimum pullback time projected by applying the trading days used by the June 2009 and January 2010 pullback. Sine the pullback this time is much stronger in terms of both size and strength so it’s reasonable to expect the pullback to last more than the previous 2 times. Basically, the time window forecast should have served its purpose, since I know logically the pullback should at least last 13 to 18 trading days so I could be sure that the pullback probably isn’t over as long as the minimum pullback time hasn’t reached. Now since the minimum pullback time has fulfilled as today is the 18th trading day since the April top, so the time window forecast is not important anymore.

WARNING: If you don’t understand the true meaning of overbought/oversold, please skip the session below. Generally, you should try your best not to trade against the trend. Trading purely based on overbought/oversold while against the trend is lethal to the health of your account. Before going further, please make sure you understand how to use the table above.

SHORT-TERM: EXPECT LOWER LOW AHEAD BUT COULD BE VERY CLOSE TO A TRADABLE BOTTOM

The most unique thing today is that lots breadth signals formed a lower low. Because usually, breadth signal has to form a higher low together with the SPX lower low at the same time to form a so called positive divergence before SPX could really be bottomed, therefore a breadth signal lower low most likely means that SPX will have a lower low ahead. The good news is that a few important indicators are very oversold now, which could mean a tradable bottom is very close now. Again, the tradable bottom, if any, should be for aggressive traders only.

The bad news first:

6.4.1 Extreme NYADV Readings Watch, NYADV extremely low almost guarantees that SPX will have a lower close ahead.

0.2.3 NYSE McClellan Oscillator, this is a record low! The good news is it’s really really very oversold now, so a rebound is due. The bad news is that NYMO new low most likely means SPX will have a lower low ahead. Take a look at 8.2.6a Record NYSE McClellan Oscillator Readings 2001-2005 and 8.2.6b Record NYSE McClellan Oscillator Readings 2007-2009 if interested, as extremely low NYMO readings seldom means an exactly bottom but very close though.

0.2.6 NYSE - Issues Advancing, new low, also the good news is it’s very oversold, the bad news is SPX is more likely to have a lower low ahead.

0.2.2 Extreme Put Call Ratio Watch, look at thick vertical red lines, CPCI extremely high usually means a top not bottom.

Now, good news. All charts below are at very oversold level which should be quite reliable.

6.3.2c Major Distribution Day Watch, Major Distribution Day rule number 3 – when NYSE Down Volume to NYSE Up Volume ratio > 35, a tradable bottom should be very close.

T2116, % stocks 2 std dev below MA(40), too high.

Intermediate-term Indicator Score representing all the sentimentrader’s intermediate-term indicators, is way too low.

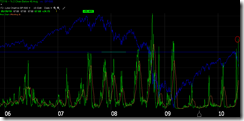

0.2.0 Volatility Index (Daily), VIX rose more 18%, as has discussed in 05/04 Market Recap, there’re more than 80% chances a green day tomorrow.