| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: NO UPDATE

SPX TIME AND TARGET ANALYSIS: THE PULLBACK COULD LAST TO 05/23

See 05/10 Market Recap for more details.

INTERMEDIATE-TERM: 05/06 LOW WILL BE BROKEN BUT NO EVIDENCE SAYS THIS IS A START OF A NEW BEAR MARKET

See 05/07 Market Recap for more details.

WARNING: If you don’t understand the true meaning of overbought/oversold, please skip the session below. Generally, you should try your best not to trade against the trend. Trading purely based on overbought/oversold while against the trend is lethal to the health of your account. Before going further, please make sure you understand how to use the table above.

SHORT-TERM: 2 REVERSAL BARS IN A ROW, DOESN’T LOOK GOOD

Nothing new to say, TEMPORARILY maintain the forecast of expecting a 2nd leg down (See 05/10 Market Recap for more details). However, I must make this very clear: the so called 2nd leg down is a general pattern we often see on a strong trend. Besides this, I have no other evidences to support the view except the time seems not enough as the total pullback time so far (11 trading days) is shorter than that of June 2009 (18 trading days) and January 2010 (13 trading days). While from the table above, however, signals are arguing that the market may have bottomed. So which one is going to be, I need see tomorrow to get more clues.

0.1.0 SPY Short-term Trading Signals, Spinning Top plus hollow red bar, so now SPY has 2 reversal bars in a row, which doesn’t look good. If you’ve paid attention to the table above, then you shall see there’re several sectors with 2 reversal bars in a row as well. So the feeling is not good for bulls.

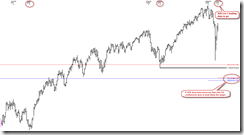

If we see the market pullback hard tomorrow to confirm today’s 2 reversal bar pattern (please pay attention to this IF condition), then be careful, it could be the 2nd leg down, and theoretically, the possible target, see chart below is around 1008 to 1016 area (I’m not saying the market will reach that area tomorrow).