| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: NO UPDATE

SPX TIME AND TARGET ANALYSIS: THE PULLBACK SWING COULD LAST TO 05/23

Nothing changed, need more information tomorrow. Although the Friday’s wave count was wrong so the initial pullback target was voided but still expect:

- A second leg down to at least test the 05/06 low

- The pullback could last to 05/23.

The reasoning is simple, the pullback this time is much stronger and bigger than the June 2009 and January 2010 pullbacks, so it should be on a higher level in terms of Elliott Wave counting. The previous 2, both had 2 down legs and lasted 17 to 27 calendar days so it’s logical to expect the pullback this time to have 2 down legs and last at least between 17 to 27 calendar days if not longer. See 05/07 Market Recap for more details.

If interested, take a look at chart 1.0.7 SPX Cycle Watch (Daily) and 1.0.9 SPX Cycle Watch (60 min), both look like a cycle top, but since both charts are messed up, so I’m not sure if they mean what they mean.

INTERMEDIATE-TERM: 05/06 LOW WILL BE BROKEN BUT NO EVIDENCE SAYS THIS IS A START OF A NEW BEAR MARKET

See 05/07 Market Recap for more details.

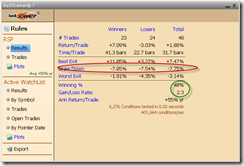

0.0.2 Combined Intermediate-term Trading Signals, looks like the primary sell signal is not a whipsaw, so this could mean that the Non-Stop Setup was triggered, so sell short RSP, perhaps tomorrow morning at open. The setup, if you could take partial profit in the middle, then the winning rate could reach 70%, but officially, the winning rate is 48%, the gain loss ratio however is 2.3 which means you could afford to loss 2 trades as long as you win 1 trade, so the 48% winning rate is not very bad.

The setup above has no stop loss, the next buy signal automatically means to cover the short position and take long position. However, trading wise, you should never take whatever position size as you wish. See the back test summary below, the max draw down is 8%, so according to How many shares to buy for each trade?, say, you have $100,000:

- 100,000*2% = 2000

- 2000 / 8% = 25,000

- 25,000 / 42.69 (RSP close price today) = 585, which means at most you can short 585 shares. Well, for fun only, YMYD.

WARNING: If you don’t understand the true meaning of overbought/oversold, please skip the session below. Generally, you should try your best not to trade against the trend. Trading purely based on overbought/oversold while against the trend is lethal to the health of your account. Before going further, please make sure you understand how to use the table above.

SHORT-TERM: MIXED SIGNAL BUT GENERALLY SHOULD BE SMALL BAR TOMORROW

As mentioned in today’s After Bell Quick Summary, VIX drop more than 20%, 6 out of 6 cases a green day the next day. The charts below highlighted all the cases when VIX dropped more than 18% (7 out of 8 a red day the next day), take a look at all those special days to see what happened thereafter.

6.1.1b Extreme CPC Readings Watch, forgot to mention this in the After Bell Quick Summary, CPC > 1.01, 79% chances a green day tomorrow.