SHORT-TERM: MAYBE TOPPED ON 05/02

Three cents:

- More pullbacks ahead.

- Still think Dollar at least should have a short-term rebound which also is one of the major reasons that I think more pullbacks ahead.

- Trading wise, I’ll sell the next bounce but with reduced positions, after all now officially the intermediate-term trend is till up.

Why more pullbacks ahead?

- SPX down 3 days in a row usually means a lower close (than that of today’s) ahead, at least.

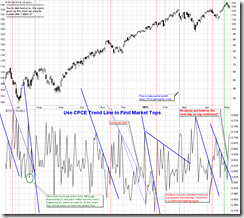

- CPCE 3 points validated trend line, broken yesterday and held for today, therefore confirms the top was in.

- A bad news todays is the OEX Open Interest Ratio surged again.

Why think Dollar at least should have a short-term rebound?

- UUP volume keeps surging plus the hollow red bar today looks promising.

- FXE is too high above the MA(200). Nothing on the planet Earth is beyond the law of gravity, so too far away from a moving average is perhaps the most reliable TA signals.

- The sentiment toward the Dollar is almost at the historical low.

INTERMEDIATE-TERM: SPX NOW IN 1352 TO 1381 WAVE 5 PRICE TARGET AREA, WATCH FOR POTENTIAL REVERSAL

See 04/27 Market Outlook for more details.

SEASONALITY: BULLISH MONDAY AND FRIDAY

See 04/29 Market Outlook for more details. For May seasonality day by day also see 04/29 Market Outlook.

ACTIVE BULLISH OUTLOOKS:

- 09/27 Market Recap: 9 POMO within 20 trading days means 14%+ up in 3 months.

- 03/11 Market Recap: Bullish in 3 to 6 months.

- 04/21 Market Recap: QQQ weekly Bullish Engulfing is bullish for the next 6 weeks.

ACTIVE BEARISH OUTLOOKS:

- 04/21 Market Recap: SPX will close below 04/20 close soon.

- 05/04 Market Outlook: At least a short-term top could have been in.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|