Two points to be noticed that:

- The market did not follow through the reversal on Thursday, and this is no good;

- Most signals are neutral, so the future direction is unknown. However I got a few interesting charts for your information.

1.1.7 QQQQ Outperforms SPY Good Sign? This is a reminder (not even a warning) that QQQQ:SPY is too high. Please note that I am not saying QQQQ is going to sell off immediately, eventually it will pay back, but when? I have no idea.

Institutional Buying and Selling Trending from www.stocktiming.com, here is the explanation from the author:

The Institutional Selling shows its trend line making higher/highs and higher/lows ... the definition of an up trend. The Institutional Buying shows its trend line making higher/highs and higher/lows ... the definition of an up trend. Institutions are showing an up-trend in BOTH ... buying and selling. This behavior does not indicate what their predominant intention is. This could mean they are rotating sectors, and/or setting up hedges.

I notice that the setup on the chart looks similar in last September when we saw a firework.

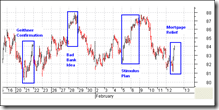

News Driven Market from www.tdtrader.com.

Compare the above chart with the following one, every time prior to the news pop market, CPC is waiting at the extremely low reading, isn't it? Now, the CPC reading doesn't show much enthusiasm to the Wednesday Mortgage Relief Plan, does it? The third time it will be different -- I guess the market will either sell off from Tuesday, or rally without sell on news and continue to go higher afterward. In another words, the market direction on Tuesday could possibly be the real direction. Lastly just to remind you that this is a wild guess, not TA, and should not be take as a guide to trading.

Trackback from:

ReplyDeletehttp://yellowroad.wallstreetexaminer.com/blogs/?p=125

Cobra,

ReplyDeleteWhen you say fireworks I assume you mean rally. I see NYA and NDX and others all poised to get up...

2c

Would last Friday be a day of consolidation for a short-term trend? There are some indications showing that bull market is going to rally. No???

ReplyDeleteBesides, it seems to me that bull market has been in a cosolidating phase since middle of last January until now. This is for an intermediary trend.

My ideal prediction (not based on TA) is that this rally is going to last until May. Then bull market will pull back sharply until October where we see market at bottom. Anyone supporting my prediction??? :)

I'm not sure if the market will rally or not. I just don't see much room left for the market to go up with so low the CPC readings and so high the NDXA50R readings.

ReplyDeleteI'm of the opinion that the market must put in a lower low than November before we can rally. The reason is simple: If the market puts in a higher low as a re-test of November and rallies off it, that means the market has reversed. No sane person believes that we're ready for a new bull quite yet (if anytime in the next few years), so a lower low MUST be put in.

ReplyDeleteTo Anon:

ReplyDeleteEveryone has been waiting for a lower low in order to determine if bull market has reached a bottom. However, my believe is that if this lower low couldn't make financial sector outperforming every other sectors, then the market isn't at a bottom yet. It is just like energy sector has to outperform other sectors in order to show market at a peak. As far as I aware of, stock market cycles are quite reliable to show market at a top or at a bottom.

Therefore, I believe in that there got to be a rally to lead financial sector above the rest.

Positive news coming out this week including:

+> Obama is expected to sign the Economic Stimulus Bill on Tuesday.

+> Geithner is likely to begin revealing details on plans to bolster “good” banks on Tuesday.

+> Obama is scheduled to reveal his “mortgage support” proposal on Wednesday.

+> News from the G7 Finance Minister’s meeting in Italy will be announced. Ministers are expected to announce coordination of economic stimulus programs.

Tom

Thanks, Hung, looks like we need a forum pretty soon. :-)

ReplyDeleteSince we are throwing out blind opinions, here is mine: future market direction over the intermediate term is currently a toss-up. Consider standing aside until we get some firm intermediate-term directional indicators.

ReplyDeleteYong Pan,

ReplyDeleteThank you very much for expanding your charts for Russell 2000 index to include Weekly, Daily, 30-min and even 15-min. I greatly appreciate it.

Like a pesky child, I have a couple of follow-up requests:

1. Can you begin regularly adding your chart annotations when you see something you deem to me meaningful and actionable.

2. Can you add Russell 2000 indicators to the charts ***that are the equivalent of*** NYADV and NYSI?

Thank you very much! Your site now feels like it is picking up energy, developing quickly, and attracting new viewers. All joking aside, I think you are on the right track about a forum. The more people in this "community" participate and share their particular insights, then the more we will all grow as analysts.

Thank you again, Yong Pan, for a great site! You've earned the right to be proud of what you have built here.

As usualy, if I see something, I'll update the related chart in my chart book. Just normally, SPX chart is enough to represent the market.

ReplyDeleteThere's no correspondent NYADV and NYSI to Russell 2000, so I cannot add them to the Russell 2000 chart. Russell 2000 generally doesn't represent the broad market.