Conclusion: I'm not impressed, let's see how it goes tomorrow.

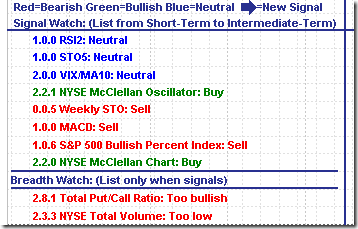

0.0.0 Signal Watch and Daily Highlights contains the latest status of the market. There is no arrow on the chart, so no change at all.

1.0.7 S&P 500 Large Cap Index (Major Accum/Dist Days). Besides the price change and volume, the Up:Down Volume has also to be considered for judging the strength of movement. Some readers may have noticed that today is not a Major Accumulation Day. It is clear on the following chart that the up:down volume is merely 1.77 today, which is far from impressive. Take a look at those up:down volumes corresponding to those big white candles, you will know what I mean.

3.0.3 20 Year Treasury Bond Fund iShares (TLT Daily). We got an issue here -- how come the bond went up so much while the stock market is so bullish? Today's candle isn't small at all, which means the money still flies to safety. Not impressive.

2.0.0 Volatility Index - NYSE (Daily). Just like the red hollow candles a few days ago, VIX didn't go down much while SPX was up huge.

Aforementioned issues are not saying today's rally is suspicious. Actually I mean many people are not convinced yet. So the true market direction is unknown until a few days later.

At the moment I have two concerns to the future direction of the market:

3.1.1 US Dollar Index (Weekly). It is extremely overbought and has reached the resistance. Where will it go next? If it pulls back, the market will be affected because of carry trade and the rebound of commodity.

2.8.1 CBOE Options Total Put/Call Ratio. The yellow region at the bottom still looks too bullish to be a sign of the market bottom.

Some interesting charts today:

1.1.6 PowerShares QQQ Trust (QQQQ Daily). It is extremely oversold, and the volume spiked up today. It looks like a capitulation and may bounce back.

1.1.A PowerShares QQQ Trust (QQQQ 15 min). The positive divergence of MACD and RSI supports the bounce back.

3.4.3 United States Oil Fund, LP (USO 60 min), it's also oversold. And the obvious positive divergence of MACD and RSI on the 60-min chart supports the bounce back as well.

5.2.0 Energy Select Sector SPDR (XLE Daily). It has dropped 7 days. The heavy volumes look like a rebound is coming from my point of view.

Here is how T2123 looks like in year 2000.

0 comments:

Post a Comment