Today is a Reversal Day. The last time I called reversal day was on July 1st 2008, however the title of the market recap on the next day was 07/02/2008 Market Recap: Reverse Reversal Day, so the follow-through tomorrow is very important.

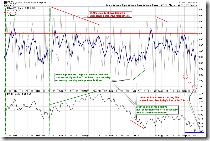

0.0.0 Signal Watch and Daily Highlights. The green signals on the left hand side of the chart has never been so magnificent. In the short-term the market is deeply oversold, so a short-term bounce is very likely. Some mid-term breadth signals have not been oversold, which might mean the bottom is not there yet, it could also be positive divergence, at the moment I do not have a conclusion yet. Recently the market often opened at low and raised immediately without any dip, and this has been so consistent that people have no enough panic to be washed out. Therefore I tend to believe that if we get a follow-through tomorrow, the bounce might be short lived.

0.0.2 Market Top/Bottomed Watch. Five indicators to pinpoint a market bottom are all signaled.

1.0.3 S&P 500 SPDRs (SPY 60 min), 1.1.8 PowerShares QQQ Trust (QQQQ 60 min), 1.2.3 Diamonds (DIA 60 min), 1.3.2 Russell 2000 iShares (IWM 60 min). Positive divergence on MACD and RSI on 60-min charts of all major indices. Very bullish.

2.0.0 Volatility Index - NYSE (Daily), Bearish Shooting Star. Very possibly VIX will pull back, which means the stock markets may rally.

1.1.C TRINQ Trading Setup. The is the only indicator which predicts the market may drop tomorrow. TRINQ is less than 0.6, which is over bullish. So far the success rate is 72%, and the last three times are all correct. So I doubt if it will be correct tomorrow, which in turn means the rally of QQQQ might continue tomorrow.

As I mentioned in the beginning, there are few charts with question marks. They might mean the mid-term downtrend is not completely over, or probably positive divergence. At the moment I do not have a conclusion.

2.2.1 NYSE McClellan Oscillator. In the last few times when the market reached the bottom, the black curve touched the green horizontal line. However the black curve is still far from that green line currently, which means the market is not oversold.

2.7.0 NYSE % of Stocks Above 50 Day MA (Daily). This chart has the similar issue. Now the black curve is still quite far from the green line.

2.4.2 NYSE - Issues Advancing. I believe the prediction of this chart is still valid, which means SPX will probably have a new close lower than 1192.

0 comments:

Post a Comment