The chances of firework (A firework means the market skyrockets high for a few days, then falls hard to the ground.) is diminishing upon today's sell off. I still see a possible firework, just not very confident now. As mentioned in the yesterday's report, we may see the worst case: Statistically, if a Major Accumulation Day happens near a new close low, that low usually holds before a firework kicks in. However there were some cases that the new close low didn't hold. The worst case was Nov 20 to 23 last year where the SPX had closed bellow that low for another 3 days. So be prepared for the SPX to close bellow 743.33 for at least 3 days. Tomorrow, however, the market may bounce and probably could close green.

Bad news first: 0.0.2 SPY Short-term Trading Signals, looks like a Bear Flag to me, so be prepared, the down leg hasn't done yet.

Now good news, before the down leg begins, still possible we may see a firework.

0.0.4 SPX:CPCE, buy setup triggered today, it was very profitable recently, hope this time it still works. By the way, this is how the word "firework" comes from.

1.1.5 PowerShares QQQ Trust (QQQQ 30 min), 1.1.6 PowerShares QQQ Trust (QQQQ 15 min), STO oversold, ChiOsc way too low, these mean a bounce at least tomorrow morning.

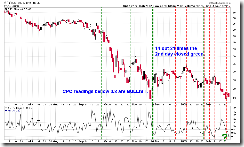

7.0.4 Extreme CPC Readings Watch, CPC < 0.8, 14 out of 21 times (67% chances) the next day closed green.

OK, if you don't see 67% chances are good chances, let's have a look at "Odd Lot Purchase Percentage" chart from www.sentimentrader.com, this chart represents retail traders who are considered as contrarian, today it fell out of the green curve at bottom which means that we retailers were scared to death. Pay attention to the vertical green lines, looks like every time that we retailers were scared to death, the next day the market always closed green. :-)

Wow great stuff. I especially love the SPX:CPCE chart. That's an amazing pattern. I'm long so hoping that it plays out!

ReplyDeleteHi Cobra, great analysis as always.

ReplyDeleteOn the extreme CPC reading. It looks to me as if the other extreme readings occurred after a bounce was underway. In yesterday's case the extreme reading occurred while the market was trading at 52-week lows.

Isn't it quite bearish when the crowd gets bullish and buys the dips in bear markets?

Yeah, that's why I said I have no confidence about CPC now. It maybe bearish this time. We'll know tomorrow if the Monday low couldn't hold. If this happens, the market will keep dropping until next Tuesday.

ReplyDeletewhy is it until Tuesday?

ReplyDeleteJust a guess, as in the report, low broken, the worst case in the past was stay bellow that low level for another 3 days, that is Tuesday.

ReplyDeleteHi Cobra!

ReplyDeleteDo you have a typo on your stockcharts page? It sais target SPX 746.

Roxy

Yes, that was a typo. Thanks!

ReplyDeleteWhat's about timing duration?

ReplyDeleteI'm asking because Lee Adler also has the target in 600s, in his case low 600s but his target is due in May. I'm curious what's yours?

Roxy

I don't think it'll be May. If 650 is the target, it'll be reached within a week or 2.

ReplyDelete