Looks like we’ll have a small gap down open. Normally it’ll be filled and the day tends to be flat.

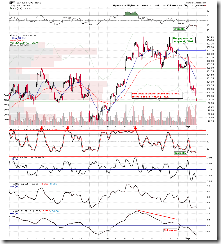

Here’s the most recent chart from www.stocktiming.com:

Chart B: Liquidity Inflows and Outflows

Liquidity inflows are critical to the market's action. If indicators are weakening while Liquidity is flowing in, then the liquidity inflow will take precedence and hold the market up. Liquidity inflows had a down tick while in extreme high territory. This is still very high, so we could see some unusually high volatility in the markets.

Chart C: Institutional Accumulation/Distribution

The Institutional Investors were in decreasing Accumulation with the Buy/Sell spread decreasing. Institutional buying decreased, and Institutional selling increased. This is now a WARNING condition, because Institutional Investors are getting closer to going into Distribution.

*** Conclusion on above charts: Conditions are still net positive but showing considerable deterioration. Also, the major indexes are showing MACD negative divergences building which have been increasing risks levels.

9:31 am: The Open.

Happy trading everyone!