Summary:

SPY sits above multiple supports. Whether the market will repeat 8/17 again remains to be seen.

CPCE top signal not confirmed.

Cycle turn date is due, looks like a bottom.

The only doubt for bulls are lots of still at record high Bullish Percent Index readings.

| TREND | MOMENTUM | COMMENT - Sample for using the trend table. | ||

| Long-term | Up | |||

| Intermediate | Up | Neutral | ||

| Short-term | Down | Neutral | ||

| SETUP | DATE | TRADE | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| SPX Major Swing | 08/21 | Buy next open | 09/10 Low - | Win: 41%, Gain/Loss Ratio: 2.9, Ann Return/Trade: 55% yr |

| NYMO Sell | 09/23 | Sell next open | *09/25 High + | Short-term play, Win: 52%, Gain/Loss Ratio: 2.3, Ann Return/Trade: 174% yr |

INTERMEDIATE-TERM: AT CRITICAL POINT, TO UP OR TO DOWN? I HAVE NO IDEA.

Bottom line, it looks very like 09/03/2009 Market Recap: Some positive signals, except that there’s no VIX ENV buy signal yet. The paid services I subscribed are divided into 2 groups, one argues the huge down leg has already started and the other argues that there maybe one more push ahead. I have no idea who’s right. Let’s wait and see.

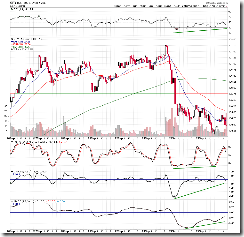

1. 0.0.2 SPY Short-term Trading Signals, closed right above multiple supports, so a rebound looks expected while even breakdown, bulls still have lots of supports below.

2. 2.8.0 SPX:CPCE, trend line didn’t hold, so the top signal is not confirmed.

3. 1.0.7 SPX Cycle Watch (Daily), a cycle is due, looks like a bottom to me.

So above all look good for bulls. The only not so “bull friend” stuff is 5.0.5 S&P Sector Bullish Percent Index I (Weekly) and 5.0.6 S&P Sector Bullish Percent Index II (Weekly), quite a few record high readings need to be corrected, so it definitely requires some imaginations to expect the market to go much much higher without taking a breath first.

SHORT-TERM: A FEW POSITIVE DIVERGENCES

1.0.4 S&P 500 SPDRs (SPY 15 min), lots of positive divergence, plus CPCI mentioned in the After Bell Quick Summary and plus possible “Sell on Rosh Hashanah, Buy on Yom Kippur” play, so a “Yom Kippur rebound” on Monday is likely.

Seasonality from www.sentimentrader.com, the last 3 trading days are “bull friendly”.

INTERESTING CHARTS: NONE