Summary:

VIX ENV/BB buy signal triggered.

TNX ROC30 bottom signal triggered.

One daily cycle is due which could mean a bottom.

CPCE top signal may be invalidated today.

Could be Head and Shoulders Bottom formed on the SPY 30 min chart.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Up | ||

| Intermediate | Down | Neutral | |

| Short-term | Down | Neutral | |

| My Emotion | Wait* | Could repeat what happened after 8/17, so be careful bears. |

I see some bullish signals today which could repeat what happened after 8/17, so there’re chances that the market may rebound huge from here. Pay attention to the trend table, accordingly, I upgraded “my emotion” to wait from down. (Well, emotion could be upgraded, that certainly is interesting. LOL)

2.0.0 Volatility Index (Daily), VIX dropped huge today, so still the chart looks like the past bullish cases. Most importantly, buy setup on chart 6.2.0 VIX Trading Signals (ENV10) and 6.2.1 Extreme VIX ENV Behaviors Watch were triggered today. Counting the green vertical lines representing winning trades vs dashed green vertical lines representing losing trades on the chart below, it’s obvious that the winning rate is quite high. So I treat these 2 buys signals as bullish.

3.0.0 10Y T-Bill Yield, green dashed lines, SPX bottomed whenever ROC30 < –9. The setup worked quite well especially recently. For the past performance about this setup please refer to 8.1.3 10Y T-Bill Yield ROC30 Watch.

7.6.0 SPX Cycle Watch (Daily), the daily cycle represented by purple lines is due in couple of days, which could be a turning point, in anther word is that now could be a bottom.

2.8.0 SPX:CPCE, the trend line didn’t hold, so the top signal I talked in yesterday report could be invalidated.

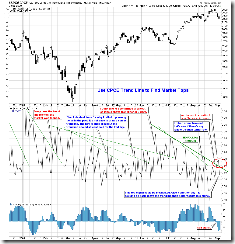

1.0.3 S&P 500 SPDRs (SPY 30 min), could be a Head and Shoulders Bottom in the forming therefore at least there’s a “bullish potential” tomorrow. Also marked on the chart are where I think bears should give up in the event that the huge rebound does kick in.