Summary:

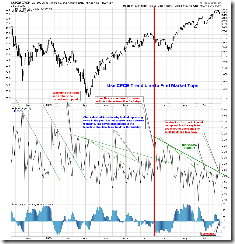

CPCE calls a market top again.

SPY short-term is down with initial target around $103.38.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Up | ||

| Intermediate | Up | Neutral | |

| Short-term | Down* | Neutral | |

| My Emotion | Down* |

INTERMEDIATE-TERM: TREND STILL IS UP BUT CPCE ARGUES FOR A TOP NOW

2.8.0 SPX:CPCE, a market top signal was triggered today. To confirm the top the trend line must hold at least for a few days.

Bottom line: 1.2.1 Dow Theory: Averages Must Confirm, the 2 days pullback was not enough to fix the record high overbought level recorded on NYA200R, BPSPX and NYHILO.

SHORT-TERM: SPY INITIAL PULLBACK TARGET COULD BE AROUND $103.38

1.0.3 S&P 500 SPDRs (SPY 30 min), because a lower low was formed and a MACD sell signal was triggered, therefore I downgraded the short-term from up to down. The initial target could be around $103.38.

INTERESTING CHARTS:

3.1.0 PowerShares DB US Dollar Index Bullish Fund (UUP Daily), record volume today. No idea bullish or bearish, just most paid services I subscribed are bullish on US$ now.

3.4.2 United States Oil Fund, LP (USO 30 min), RSI is way too oversold so there could be a short-term rebound. Just if you believe the US$ is bullish then on the intermediate-term oil should be bearish.