| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

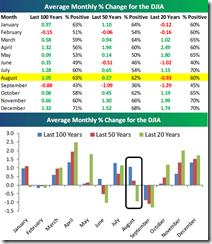

SEASONALITY: THE FIRST NINE TRADING DAYS OF AUGUST ARE HISTORICALLY WEAK

According to the Stock Trader’s Almanac:

- First trading day in August, Dow down 9 of last 12.

- First nine trading days of August are historically weak.

The chart below is from Bespoke.

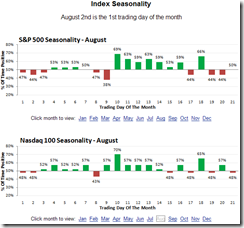

The chart below is from sentimentrader.

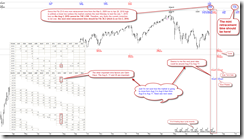

INTERMEDIATE-TERM: THE CORRECTION SINCE 04/26 ISN’T OVER, THE REBOUND SINCE 07/01 IS OVER OR CLOSE

The bottom line:

- The correction since 04/26 is not over.

- The rebound since 07/01 could be over or very close to be over. The thing I’m not sure is whether there still will be a new recovery high (higher than 07/01 high) ahead.

Why isn’t the correction since 04/26 over?

Firstly, the correction time is not enough. See chart below. I mentioned that the mini mini correction time is Fib 23.6% from 03/06/2009 low to 04/26/2010 high which is on 08/02. However, now chances are pretty low that the 08/02 low is lower than the 07/01 low or at least equal, so apparently the 08/02 is not the low. While if the 07/01 low is the low, then the correction time is way too short. So if the Fib 23.6% on 08/02 is not the low then the next Fib 38.2% at 10/02 should be the only logic time when the correction could be over. Right?

Secondly, the rebound since 07/01 is much much weaker comparing with the last year. It doesn’t look like that a new bull has kicked in. The chart below should be self explanatory enough.

Why could the rebound since 07/01 be over? The chart below should also be self explanatory enough. It’s a little bit complicated to do the back test, so I did a visual back test. It looks to me, since year 2000, if SPX made a higher high then had a very first 3 down days in a row, 70% to 80% chances it led to a little little bit bigger correction. Besides, don’t forget the August seasonality is not very bull friendly especially the very first 9 trading days.

If indeed we have a little little bit bigger correction ahead, will it test the 07/01 low? Well, I don’t know yet.

By the way, in the time analysis chart above, I also listed lots of potential pivot dates, such as 08/02, 08/06, 08/09, 08/11, 08/16, 08/23, 08/26. They all have multiple sources from different angles to back them as important dates. For now I have no clue yet on how the market will react to those pivot dates. Just listed here for your early references. Personally, I think the 08/09 to 08/11 and 08/23 to 08/26 are the 2 most important time windows.

SHORT-TERM: MIXED SINGALS FOR THE NEXT MONDAY, I’M A LITTLE BIT BEARISH BIASED THOUGH

In the Friday’s After Bell Quick Summary, I mentioned that chances are good we’ll see a green Monday. However from the 2 new evidences below, looks like bears may have a little little little little bit better chances:

Long up shadow in 60 min chart doesn’t look good.

SPY fell only 2 cents on Friday but TNX dropped more 3%, as you all know that TNX generally leads SPX so this could hardly be a good news. Short at Friday’s close then cover at Monday close since year 2000, you have 72% chances。

The charts below are all from sentimentrader. The Rydex (retailer) traders are very bullish and AAII (also retailers) are not bearish at all. Info only, because I certainly don’t want to see someone comments again (happened a lot in my forum) saying because retailers are way too bearish so the market will rise huge.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | UP | 4.1.1 Nasdaq 100 Index (Weekly): Bearish 1-2-3 formation, target 1565. |

| IWM | UP | |

| CHINA | UP | |

| EMERGING | UP | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): Bear Flag?; EEM:$SPX too high. |

| EUROPEAN | UP | 4.1.7 Vanguard European VIPERs (VGK Weekly): Bearish 1-2-3 formation, target $35.45; Bear Flag? |

| CANADA | DOWN | 4.1.5 iShares CDN S&P/TSX 60 Index Fund (XIU.TO Weekly): Bearish 1-2-3 formation, target $15.30. |

| BOND | UP | |

| EURO | UP | |

| GOLD | DOWN | |

| GDX | DOWN | |

| OIL | UP | 4.4.0 United States Oil Fund, LP (USO Weekly): Bear Flag? |

| ENERGY | UP | 4.4.1 Energy Select Sector SPDR (XLE Weekly): Bearish 1-2-3 formation, target $43.14. |

| FINANCIALS | DOWN | |

| REITS | UP | |

| MATERIALS | UP |