| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SEASONALITY: WEEK AFTER JULY EXPIRATION, DOW DOWN 7 OF LAST 11

See 07/16 Market Recap for more details.

INTERMEDIATE-TERM: THE CORRECTION ISN’T OVER YET

See 07/02 Market Recap and 07/16 Market Recap for more details.

SHORT-TERM: THE REBOUND MAY HAVE FURTHER TO GO

My guess is that the rebound may have further to go. See chart below, seldom if not never, a very high black bar at bottom marks a top. Similar to break a car, it must slow down first before eventually being stopped. Very high black bar means the breadth is very strong which equivalent to an accelerating forward car, so chances for the market to make a sudden fall are not high.

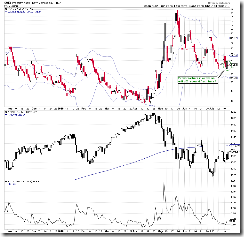

The chart below shows the estimated price and time target. For time target, if you agree the logic of mini 5 rebound days shown on the chart, then the rebound would last to 07/27 or 07/28. See table above, 07/27 happens to have multiple Gann Day due plus it’s the Turnaround Tuesday and plus according to 6.5.2b Month Day Seasonality Watch, the last 2 trading days of the recent 11 months were bearish. So looks to me 07/27 to 07/28 is more likely the pivot date.

Two charts I want to bring your attention, not necessarily mean a down day tomorrow but as long as they’re there, I don’t think the market could go too far.

0.2.0 Volatility Index (Daily), VIX mostly didn’t agree today’s big rebound forming 2 reversal like bars in a row, so it could rebound, which is not good for the stock market. Besides, the VIX to VXV ratio below is still too low, not good.

Nasdaq Intraday Cumulative TICK (courtesy of sentimentrader), anther WOW again today. The previous 10 times when I WOW-ed, the market all had a little bit bigger pullback within a few days. (See 07/13 Market Recap, 06/30 Market Recap, 06/25 Market Recap, 06/02 Market Recap, 05/26 Market Recap, 05/18 Market Recap, 05/12 Market Recap, 05/03 Market Recap, 04/29 Market Recap, 04/20 Market Recap and 04/14 Market Recap)

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST