| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

Well, guys, today’s report is late and it wasn’t easy. I broke my Windows XP last night and tried in vein to restore the XP (so that I don’t need to reinstall all the other software) until 4am and finally gave up. So at 8am, after a small nap, I started to install Windows 7 and every other software until 2pm (fortunately, so far I don’t see I lost any of my work). The report began on 4pm after another nap. Well, here it goes. A promise is a promise and I sure will try my best to stick to it, no matter what.

SEASONALITY: BEARISH EARLY NEXT WEEK, BULLISH LATER

The early next week is bearish while the later week may be bullish. Overall, according to 6.5.2c Week Seasonality Watch, the whole next week may end in red eventually.

According to Stock Trader’s Almanac:

- August next to last trading day, SPX up only twice in last 13 years.

- First trading day in September, SPX up 11 of last 14.

The chart below is from sentimentrader, showing seasonality around Labor Day.

6.5.2b Month Day Seasonality Watch, also says the early next week is bearish.

INTERMEDIATE-TERM: STATISTICS ARE BEARISH, THE NEXT PIVOT DATE IS AROUND 09/07 TO 09/10

For the intermediate-term, I have no hard evidence arguing that 08/25 WAS NOT THE BOTTOM. Things I’m certain are:

- The bearish statistics mentioned in 08/20 Market Recap are still valid.

- 6.2.3 VIX:VXV Trading Signals is still too low.

- The weekly NYSI STO in 4.1.0 S&P 500 Large Cap Index (Weekly) is not at a bull friendly position.

- The next pivot date is around 09/07 to 09/10. Not sure it means a top or bottom though.

Overall, I’m inclined to believe that this is just a rebound that won’t go too far.

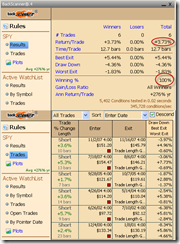

Since T2105 keeps making new high (see 08/20 Market Recap and 08/24 Market Recap), so I tightened the test conditions again: Sell short at close when MACD(10, 200, 1) > 0.82 (so called normalizing), cover when MACD(10, 200, 1) < 0.82, well, 100% winning rate since year 2000.

The chart below is the visual back test of the above test results. For you to “feel” it.

The chart below should be clear, why 09/07 to 09/10 could be the next pivot date. Although, the cycle and Non Farm Payroll both are arguing that 09/06 (Remember the magic day 6? See 08/03 Market Recap about in the past 10 years, lots of important highs/lows happened around 6) could be the pivot date, but the problem is that 09/06 is the Labor Day holiday. At the current stage, it’s hard to say whether the coming pivot date means a top or bottom, and I’m still wait for the 3rd party document to perhaps provide more specific date.

The chart below explains why I treat the Non Farm Payroll day as a potential pivot day. In fact, I guess, the magic day 6 mentioned above could probably related to the Non Farm Payroll day which is scheduled on the first Friday every month that may easily happens around day 6.

SHORT-TERM: HIGHER THEN THE FRIDAY’S HIGH IS GUARANTEED, THE MAX REBOUND TARGET IS SPY $108.87

The bottom line:

- A high that is higher than the Friday’s high is guaranteed.

- The Double Bottom text book target is SPY $108.87.

The rebound should last more than just the Friday. The reasoning is simple: law of inertia, a forward accelerating car could not be stop without decelerating first. See chart below, have you ever seen a Major Accumulation Day happening exactly on a market top? Therefore at minimum of minimum, there should be a high sometimes next week that is higher than the Friday’s high.

1.0.6 SPY Unfilled Gaps, this chart also guarantees, a Monday gap down open, if any, will be filled, because an unfilled Monday gap down would mean a back to back unfilled gaps which are very very rare.

As for the rebound target, I believe everyone now sees the Double Bottom pattern with the text book target around SPY $108.87 and happens to be on Fib 50%. And the coincidence makes the target look more logic. (Hmm, I’m wondering, anyone likes to say that since everyone is aware this Double Bottom pattern, so it won’t work? Well, anyone? Please raise your claw.)

Personally, I believe such a text book target could be the maximum the rebound could go this time.

Why could it be the maximum the rebound can go? The main reason is, as mentioned in the intermediate-term session above, the 6.2.3 VIX:VXV Trading Signals is too low. You should still remember the reversal of reversal of reversal bottom pattern I mentioned in the 08/26 Market Recap. Now let’s take a look at the chart again. This time, let’s compare all the past 4 bottom patterns. Looks to me, the reversal of reversal of reversal we had this time, not only is the weakest but also the VIX:VXV is the lowest. And an interesting thing is, the rebound target, if still follows the past rate, is SPY $109.31 which happens to be around the Double Bottom target I mentioned above.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | DTMFS | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | DOWN | ||

| IWM | DOWN | ||

| CHINA | UP | Head and Shoulders Bottom in the forming? | |

| EMERGING | DOWN | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. | |

| EUROPEAN | DOWN | ||

| CANADA | UP | ||

| BOND | UP | 4.2.0 20 Year Treasury Bond Fund iShares (TLT Weekly): Too far away from MA(200). | |

| EURO | DOWN | ||

| GOLD | UP | ||

| GDX | UP | BUY | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high. *3.2.1 Market Vectors Gold Miners (GDX Daily): ChiOsc is too high. |

| OIL | DOWN | ||

| ENERGY | DOWN | ||

| FINANCIALS | DOWN | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? | |

| REITS | DOWN | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging, be careful. | |

| MATERIALS | DOWN |